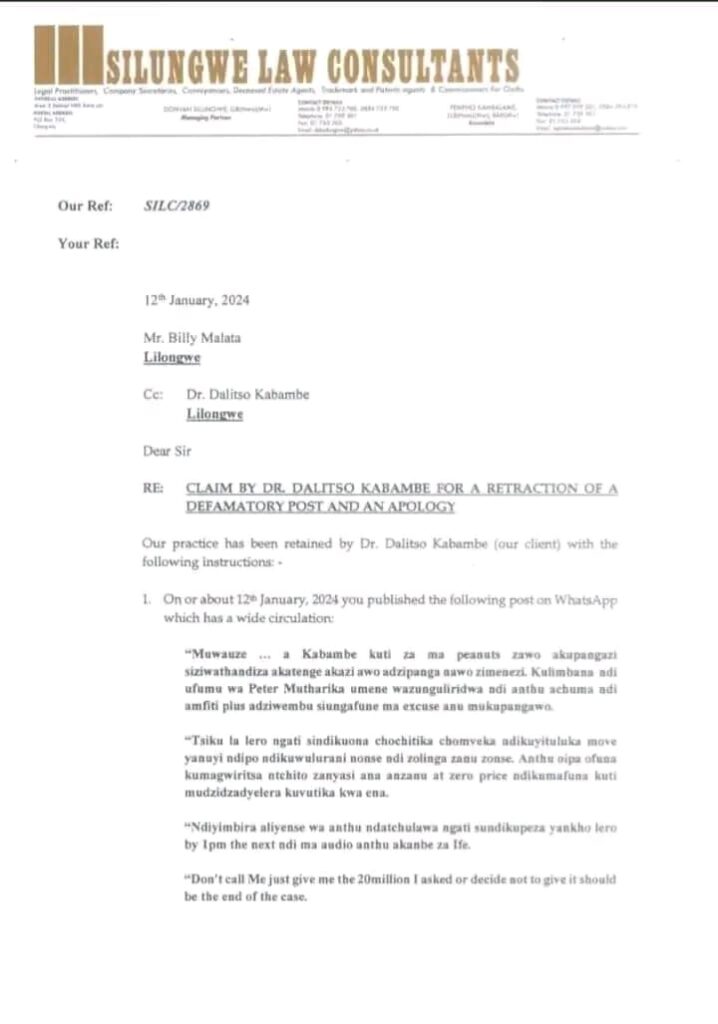

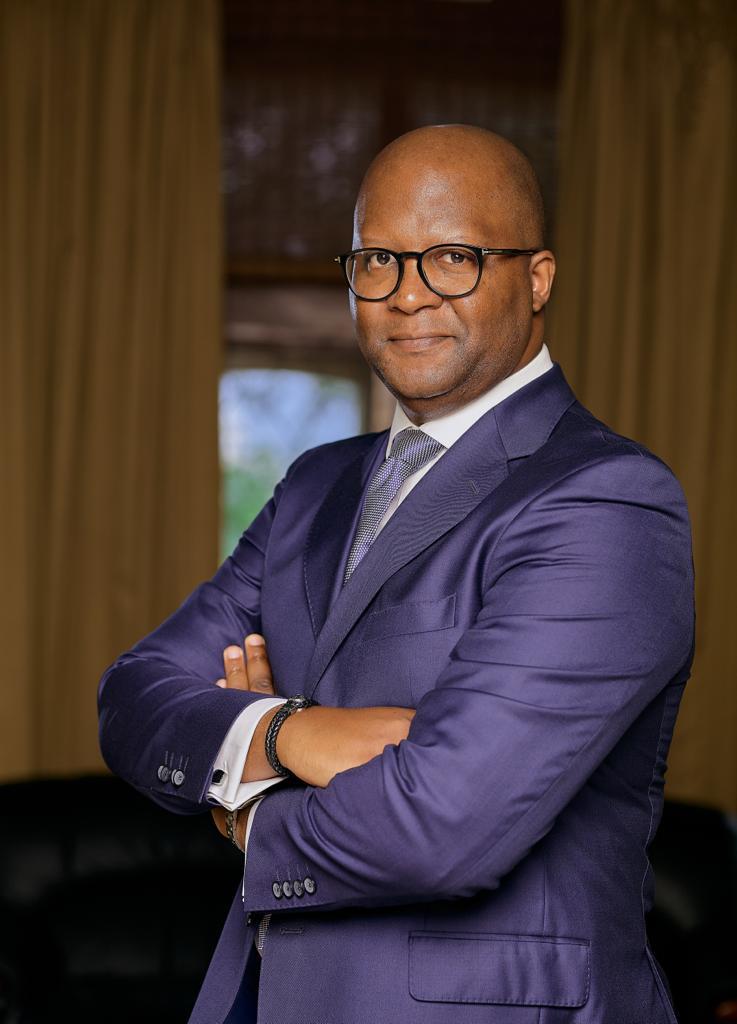

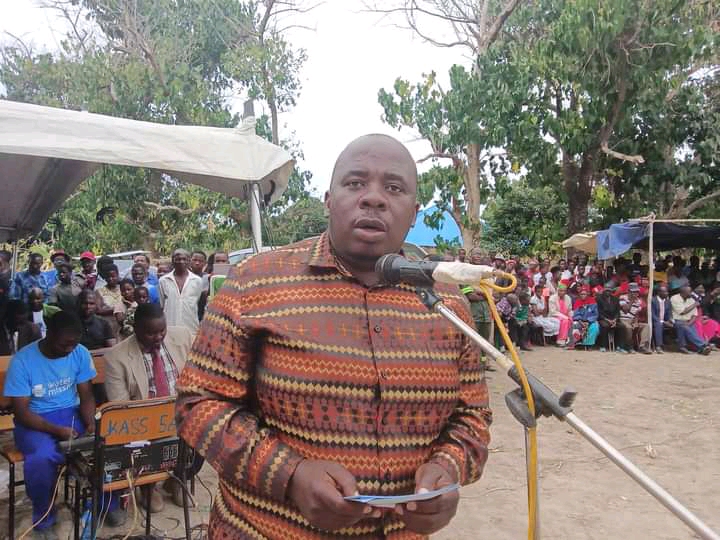

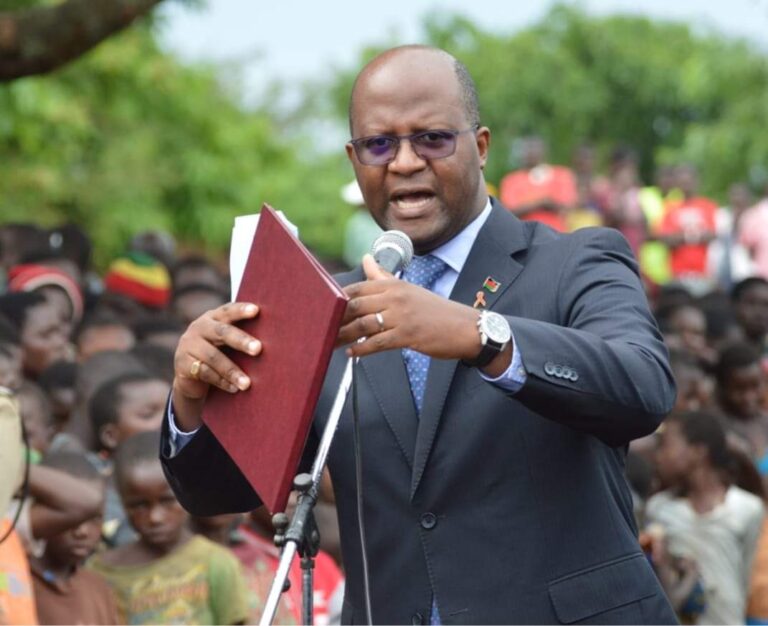

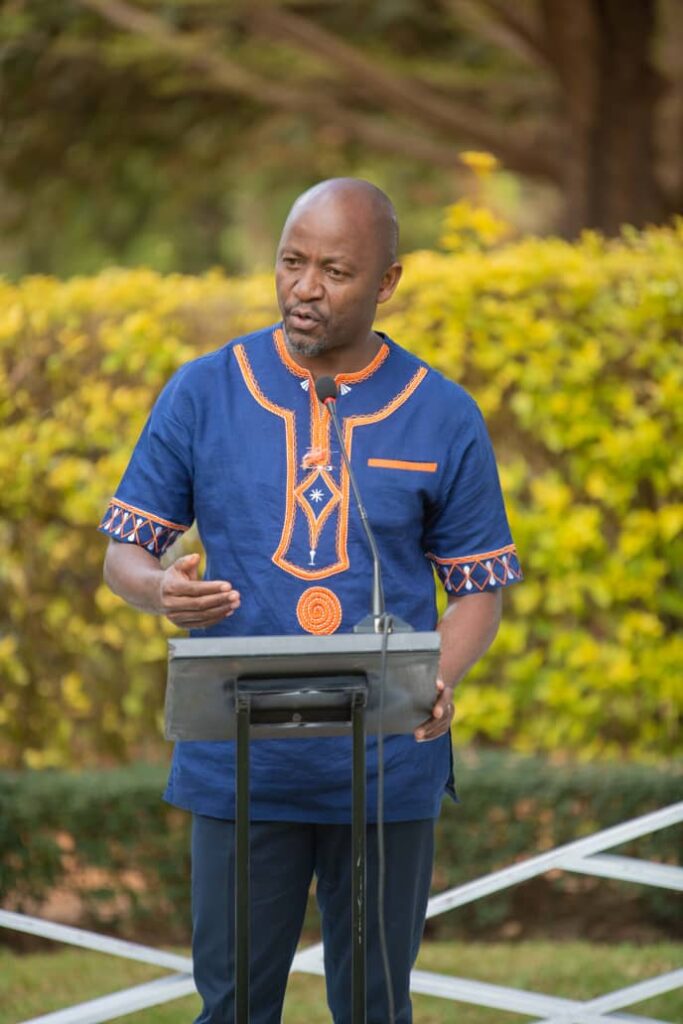

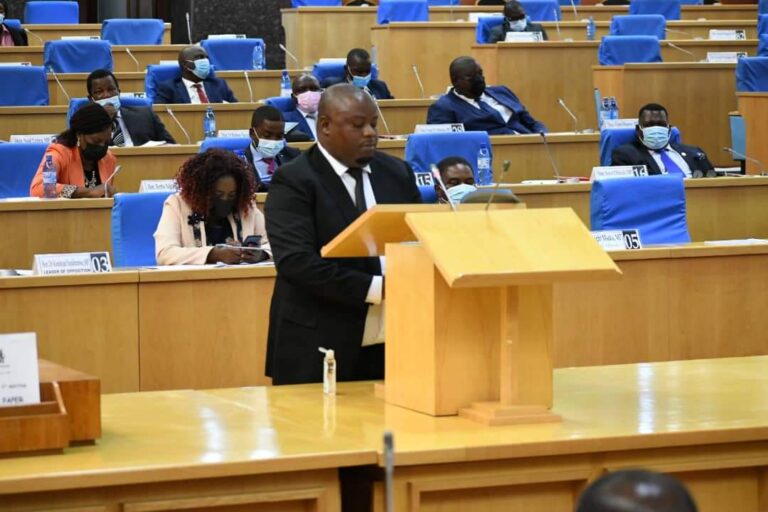

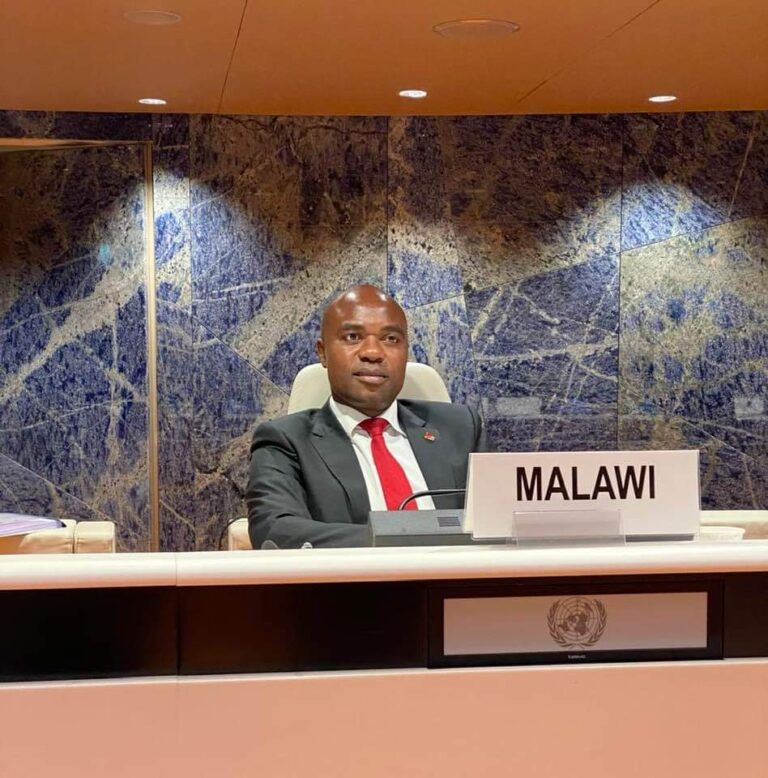

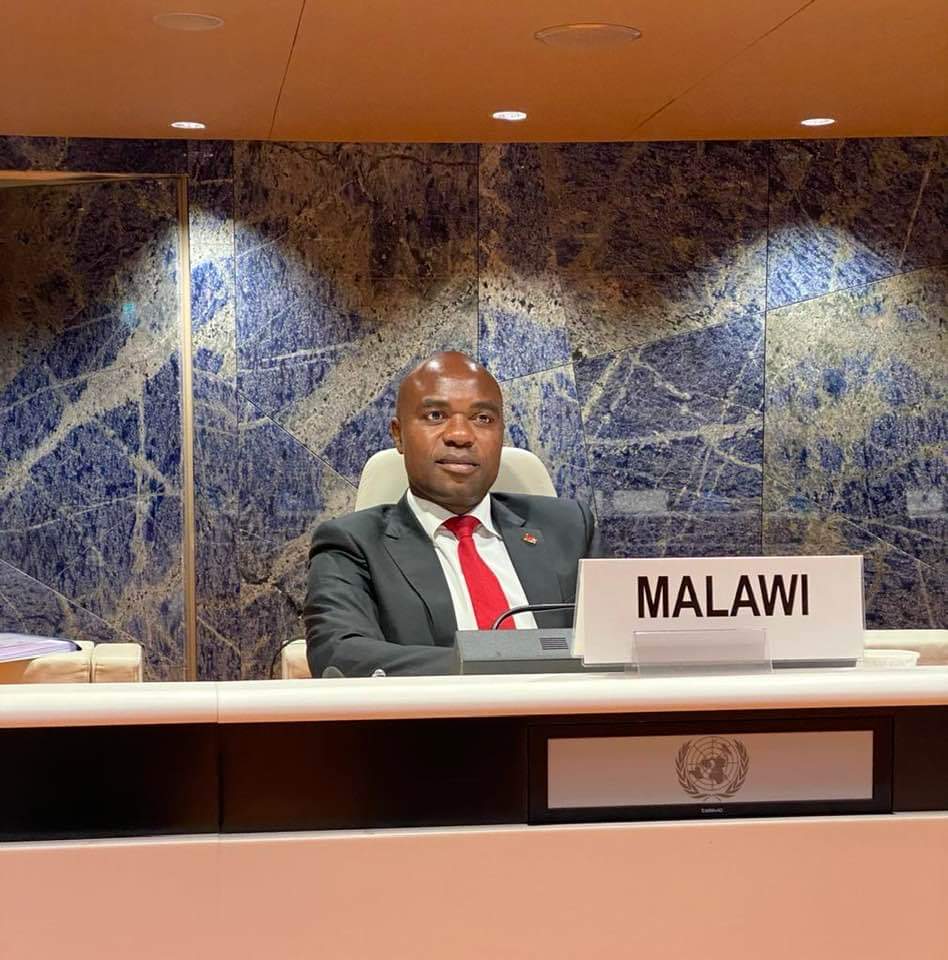

RESPONSE BY RIGHT HONOURABLE DR. KONDWANI NANKHUMWA, MP, LEADER OF THE OPPOSITION IN PARLIAMENT TO THE STATE OF THE NATION ADDRESS (SONA) BY HIS EXCELLENCY PRESIDENT LAZARUS CHAKWERA LILONGWE

20 February, 2023

THEME: “TALK IS CHEAP, LIES HAVE SHORT LEGS”

PREAMBLE

Let me begin by saying that what President Lazarus Chakwera delivered last Friday does not come any close to a State of the Nation address (SONA). It is the reason why I have entitled my address as “Talk is Cheap, Lies have short legs”.

Madam Speaker,

SONA is a yearly tradition when the President of a nation comes to report on the status of the country whilst unveiling the government’s agenda for the coming year including proposing certain legislative measures to Parliament.

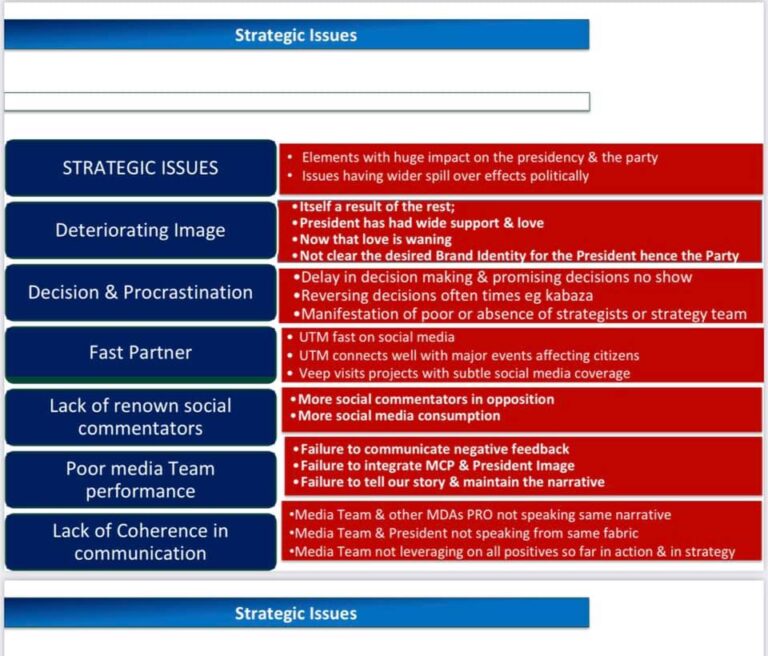

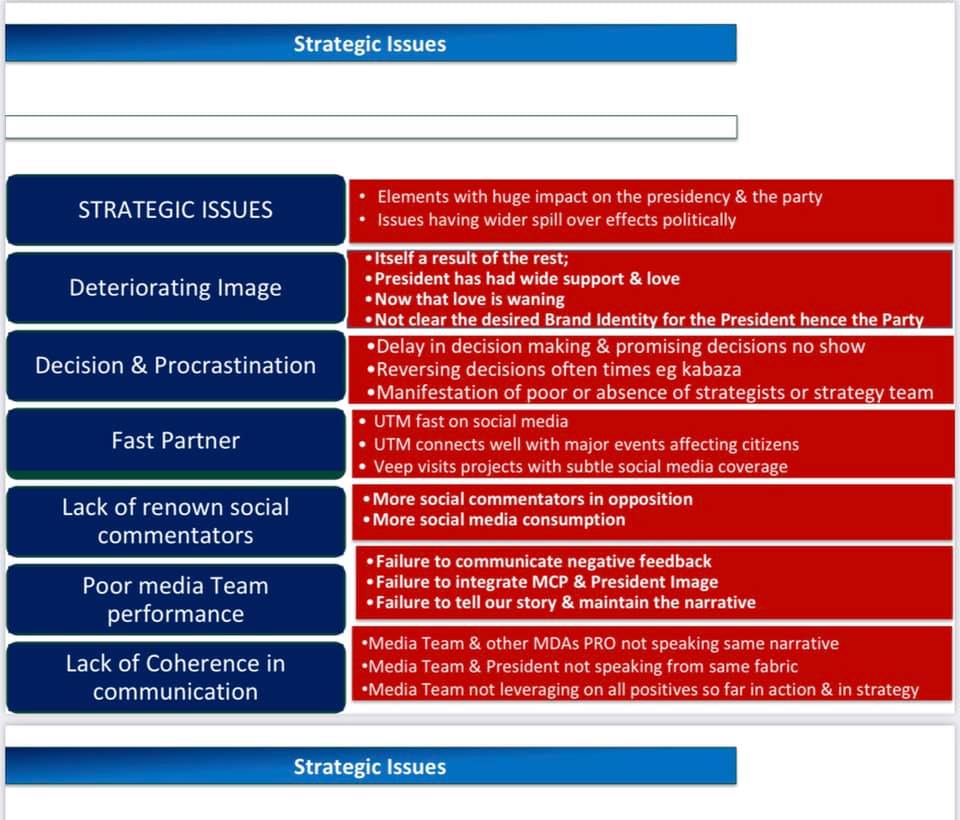

It is clear that the speech that President Lazarus Chakwera delivered in this August House lacked these key characteristics. Most likely, the President himself does not have a clue on the status of this nation.

No wonder, the President failed to outline a clear agenda for his government in the coming year. That is not surprising, because you cannot provide a prescription without diagnosis.

Madam Speaker,

You diagnose first before prescription.

There is no progress report in the speech by the President as to what exactly has been achieved between what was said last year and the not surprising statement being considered as SONA this year. There is a total disconnect between the 2022/23 SONA and the 2023//24 SONA.

Madam Speaker,

Let me pick one example to illustrate my assertion on the failure and emptiness of this so-called SONA. The President emphatically talked of “fixing the broken systems”. The simple question is “what broken systems have been fixed to this day”? Is that too much to ask from the President?

What we witnessed on Friday last week is a man who is lost and does not know what direction to take and what options are available for him as President of this country.

We witnessed a man, who lacks self awareness; who cannot differentiate between a State President that he is and someone aspiring to be a State President. He is a President who is still promising three years down the line.

Here is a President who, instead of giving Malawians a status update of the country, is busy hallucinating what he thinks he will do. He is clearly stuck in the la-la land of speeches forgetting that he has a country to lead.

Madam Speaker,

Malawians are now used to their President being absent on critical issues; of being told that their President did not know anything when serious decisions on national matters were made.

I am now left with no doubt that President Chakwera does not know the pain that Malawians are going through under his leadership. Let me tell President Chakwera what Malawians are going through.

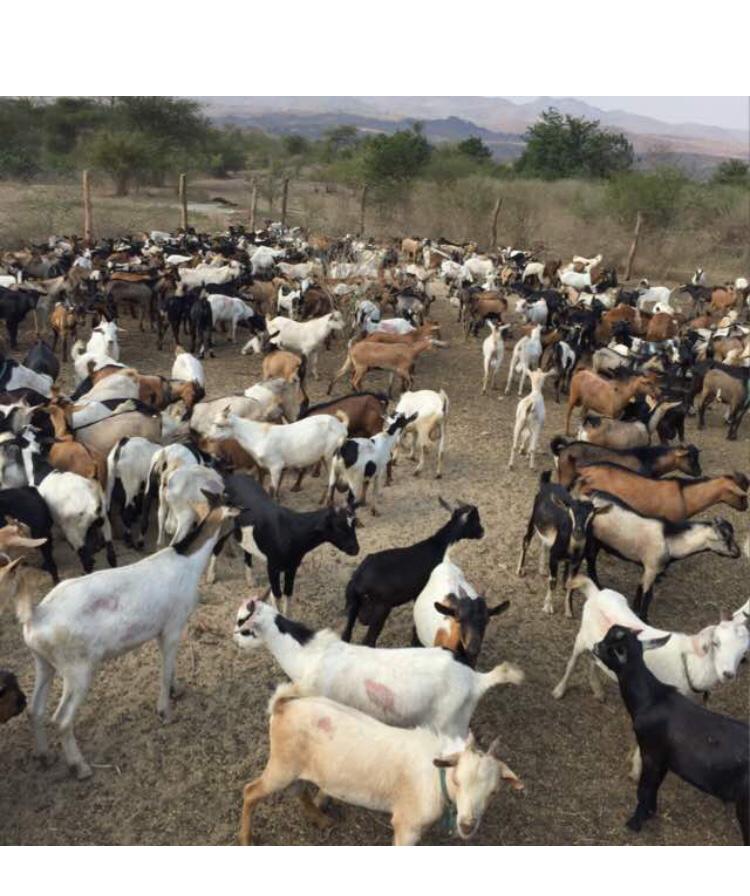

ON AGRICULTURE

Madam Speaker,

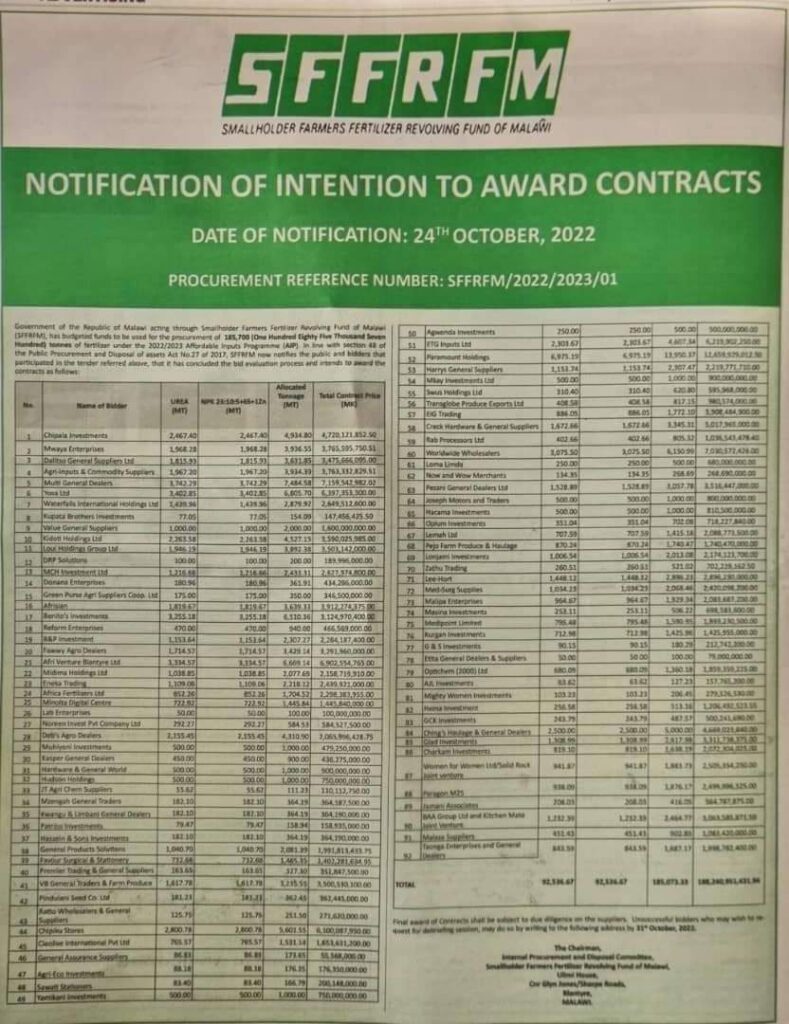

The President admitted that the Affordable Input Program (AIP) has been a mess this season. Fine. However, he should have gone further to tell Malawians why the program came crashing down rather than glossing over the matter with niceties, including outlining figures that did not reflect the situation on the ground.

Madam Speaker,

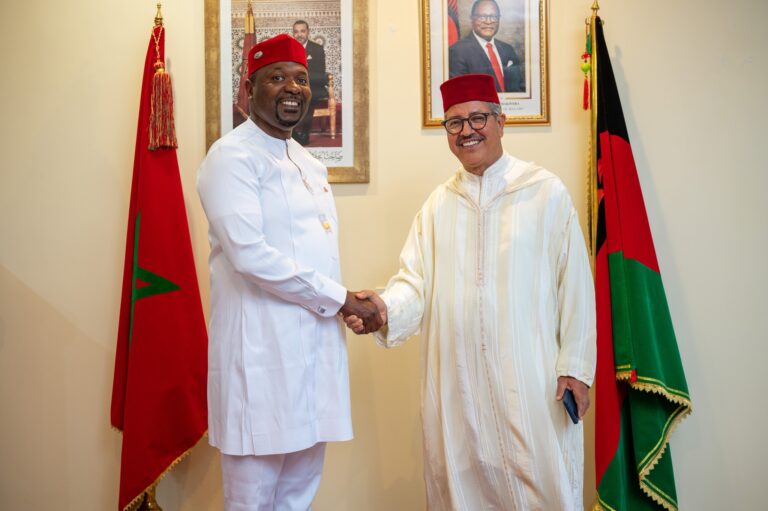

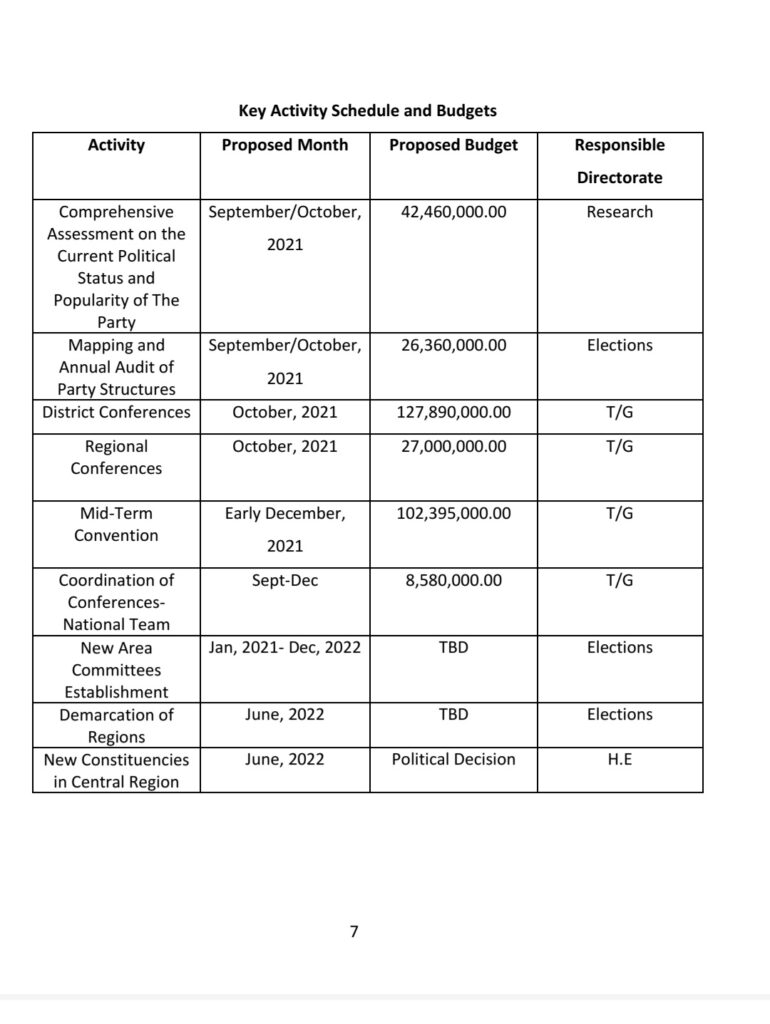

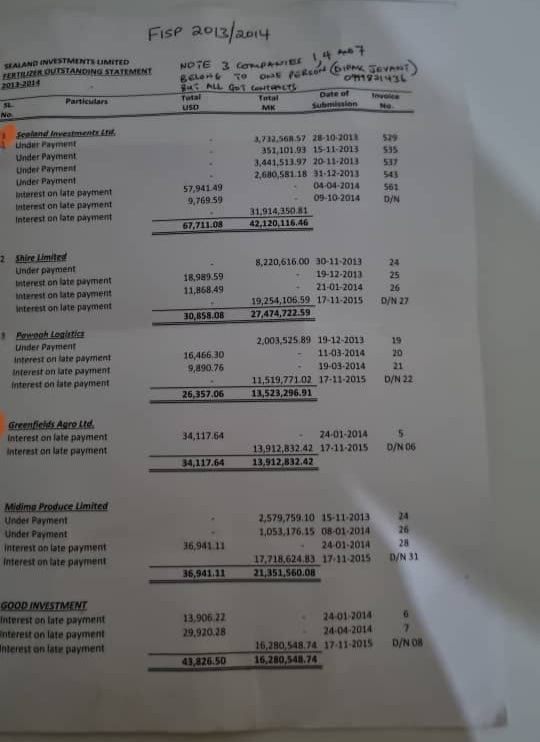

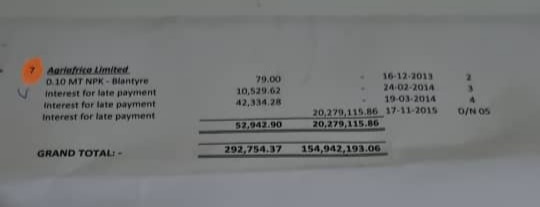

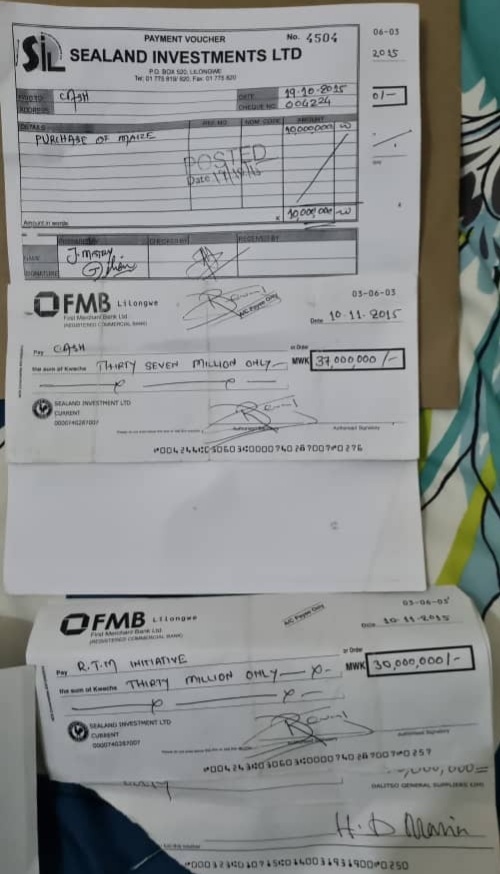

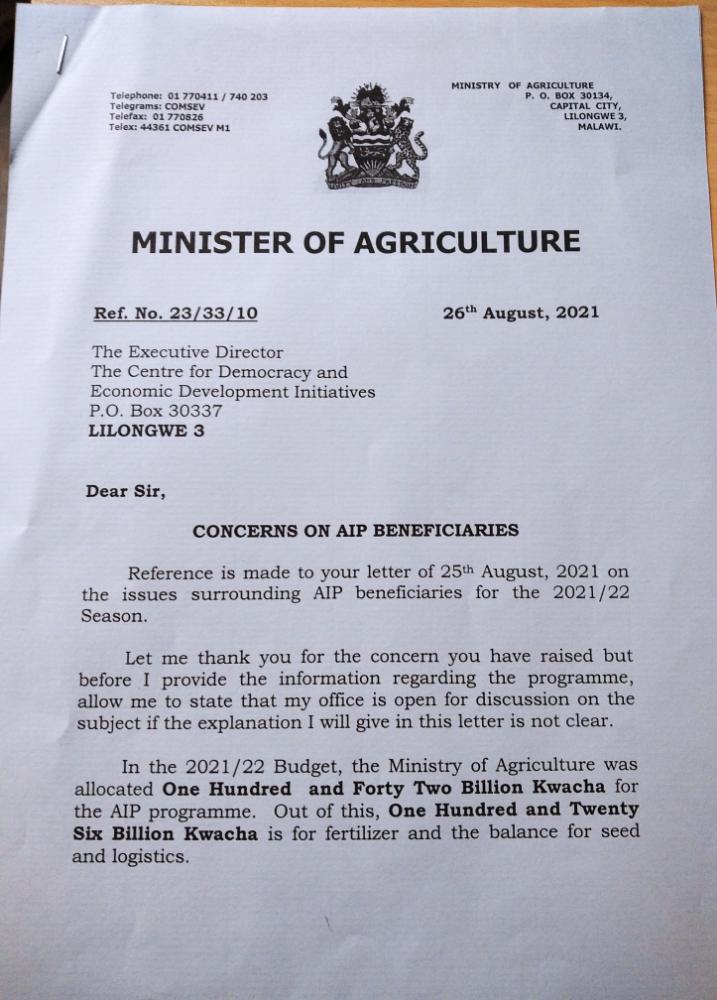

In the 2022/2023 budget, Parliament allocated K109 billion for AIP. Since that time, a series of events followed including the cancellation of local fertilizer supply contracts apparently because the government had secured fertilizer donations from Morocco and Russia.

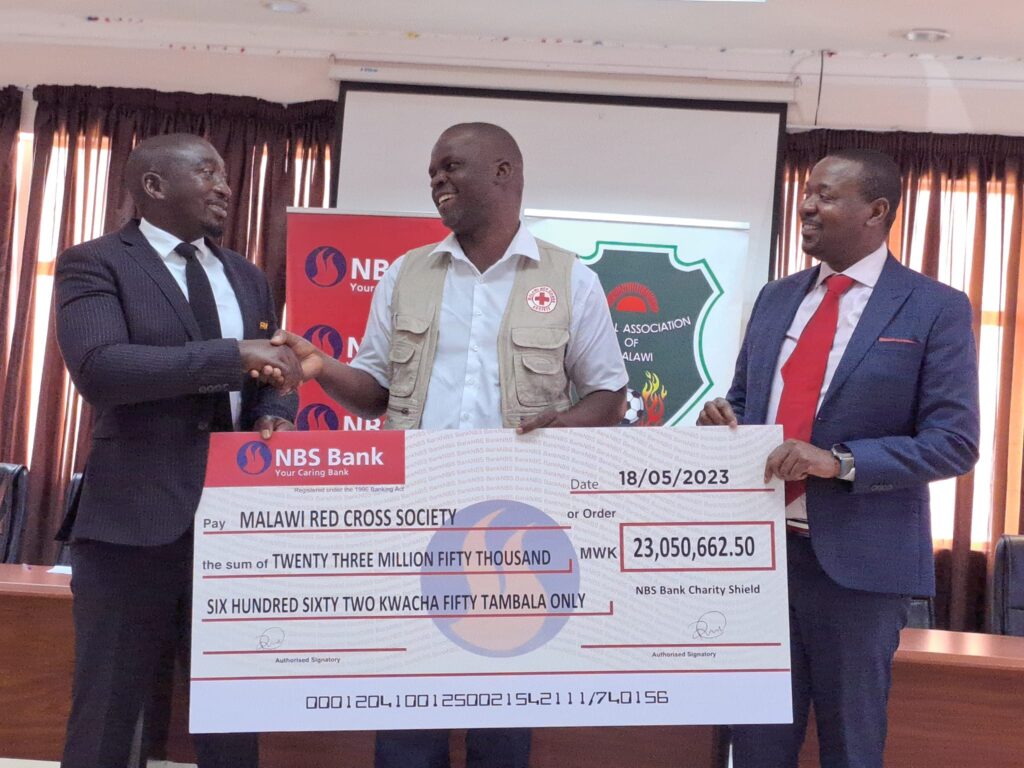

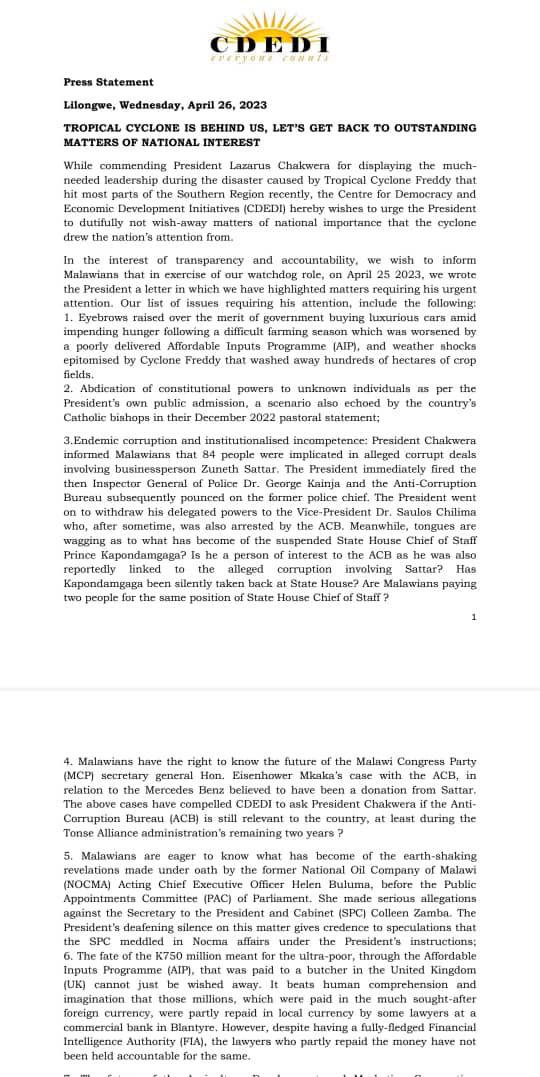

The next thing, we learned that the government has been duped of K30 billion by conmen in its quest to buy fertilizer from a butchery in the UK. The Ministry of Agriculture denied the K30 billion figure, claiming the duped amount was just K750 million kwacha. Government is yet to recover this taxpayers money.

Madam Speaker,

There have been so many lies and dishonesty over the whole AIP program, which is why some of us said from the onset that it was doomed to fail. For example, the total allocation of 97 billion kwacha for fertilizer purchase was only enough to cater for 900,000 beneficiaries.

The 92,000 Metric tonnes of the donated fertilizer was also enough for 900,000 beneficiaries, bringing the total number of beneficiaries to just 1.8 million at most. This is in total contrast to the 2.5 million beneficiaries that the government said it would target. The government therefore cheated its own citizens by promising that 2.5 million people would benefit from AIP this season.

Madam Speaker,

As if that was not enough, there have been unprecedented late deliveries of both types of fertilizer to selling points. In many cases, fertilizer was accessed way after the crop had tussled.

There has also been unavailability of UREA fertilizer across the southern, Eastern and Northern regions while their counterparts in the central region were oversupplied. The clear lack of capacity by the only distributor, the Smallholder Farmers Fertilizer Revolving Fund of Malawi (SFFRFM) only worsened the situation.

Madam Speaker,

Some MPs from the eastern and southern regions had to take matters into their own hands to camp at SFFRFM headquarters to force the organization to release UREA to their areas. This is not the job of MPs but there are times when push has to come to a shove.

As if this was not enough, the government has been collecting money from poor AIP beneficiaries while promising to give them fertilizer at a later date, and in many cases the fertilizer did not come. This is to say the least abuse of citizen’s rights and pure theft by the government.

Madam Speaker,

I can go on and on to describe the mess that has been AIP this season, but this is what I want to tell President Lazarus Chakwera. His acceptance that AIP faced challenges this season is not nearly enough and not acceptable because it is a man-made crisis that Malawians can ill afford.

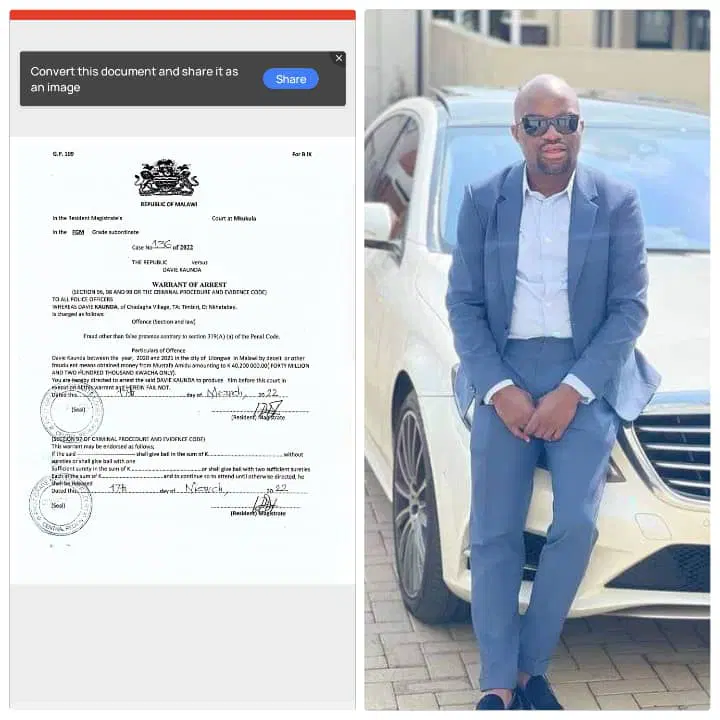

As the opposition, we helped in passing the budget, including advising the government on the design and implementation. But look at what they did. Incompetent Ministers started flying around looking for fertilizers in bizarre places. Middlemen, including the President’s own relatives made deals under the guise of looking for fertilizer, and huge sums of money were stolen.

Madam Speaker,

Did we not end up buying fertilizer from a butchery? And Instead of being swift and decisive, President Lazarus Chakwera remained passive as though nothing happened. He swapped around the same faces that messed up the program in the first place hoping for different results. No, Mr President.

Now, we hear that even the donated fertilizer has also been stolen. Out of the 20,000 metric tonnes meant for Malawi, only 9,000 metric tonnes arrived in the country. The rest vanished in thin air or ended up in Mozambique. No one seems to come up with a plausible explanation.

What is disturbing is the fact that the same ‘connected’ and ‘untouchable’ presidential relatives, who played a key role in the procurement of fertilizer from a butchery in the United Kingdom, have also been mentioned in the grand theft of donated fertilizer.

Madam Speaker,

My question to President Lazarus Chakwera is: How far are you willing to go to sacrifice poor Malawians at the altar of family relations?

The President talked about re-designing the AIP framework to improve its efficiency. But let me assure him that we will be here talking about an even worse AIP mess next season if he allows his inner circle to use AIP as an instrument to enrich themselves through corruption, kickbacks and commissions.

Already, a report by Famine Early Warning Systems Network (FEWS NET) says Malawi will face hunger this year. It says crop production in Malawi in this season is likely to be below last year. It says maize production is estimated to be 30 to 50 percent below the five-year average. The government should not be surprised with this projection because that is the result of its investment in mediocrity and corruption.

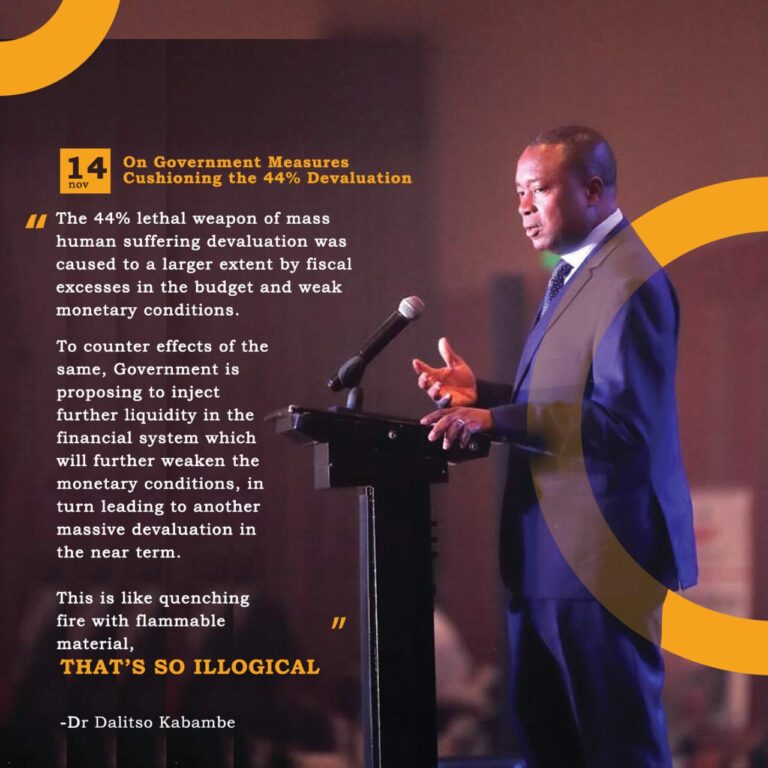

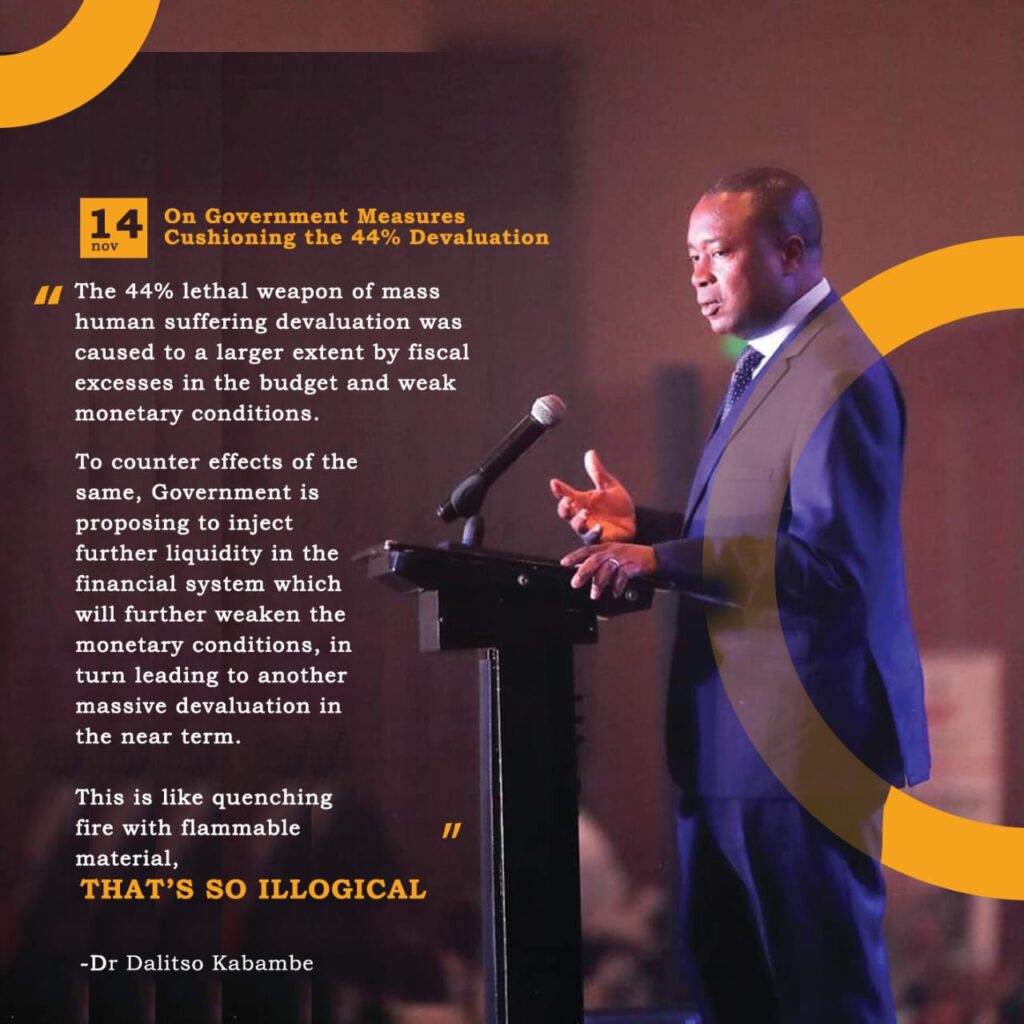

ON THE ECONOMY

Madam Speaker,

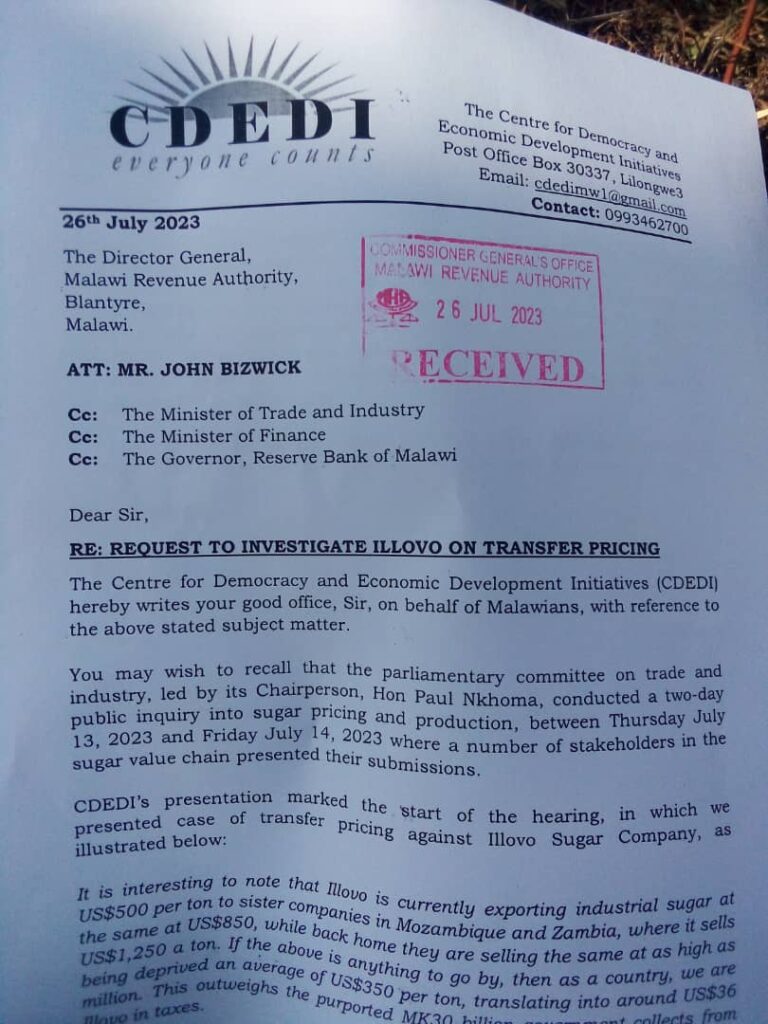

That this country is sailing through troubled economic waters is evident even to a toddler. The President made an honest assessment that a slew of our macro-economic indicators don’t make good reading. For example, inflation is in double digits; our debt levels are the highest in the history of the country and very unsustainable.

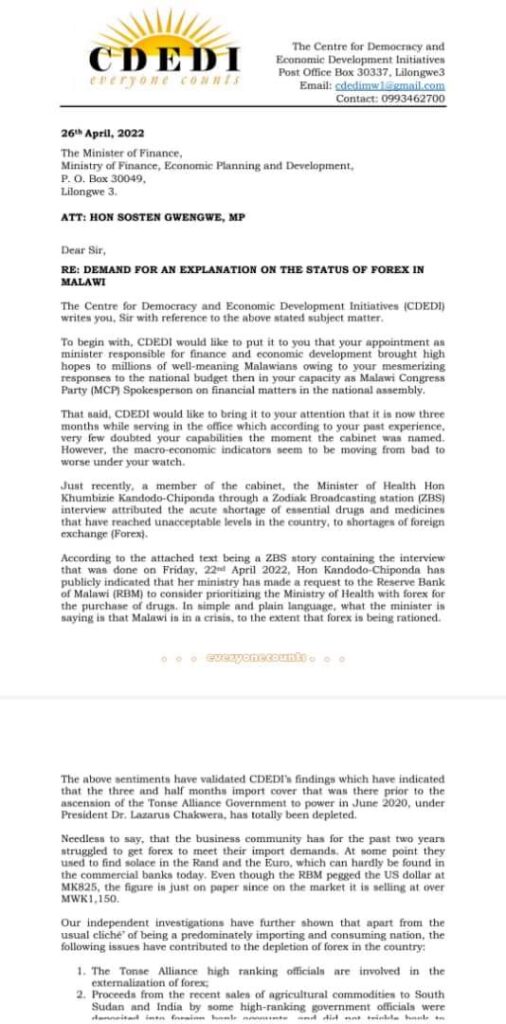

The prices of basic commodities continue to rise beyond the reach of common Malawians. The Forex and fuel scarcity situation is still in flux and a typical case of ‘now-you-see-me-tomorrow-you don’t’.

Various stakeholders have talked and still talk about the glim and hopeless future that Malawians face under this administration. It is sad that the government continues to be business as usual with nothing happening on the ground to give hope to Malawians. Our economy has typically tanked, and hope is lost.

Madam Speaker,

The President entitled his speech as “Delivering Economic Transformation and Governance Reform through Sacrificial Action and Service Excellence.” Maybe the President must come clear on this one.

For example, which governance reforms? Sacrificial action from who? Malawians or the President and his ruling establishment?

If it is about taking sacrificial action, this government does not understand that language. President Chakwera is always the first to disobey his own austerity measures. He travels furiously and internationally in a hired private jet burning fuel and the little Forex we have, often with a large entourage earning fat allowances.

He travels locally often with a larger than life entourage carting allowances and conducting useless development rallies.

Madam Speaker,

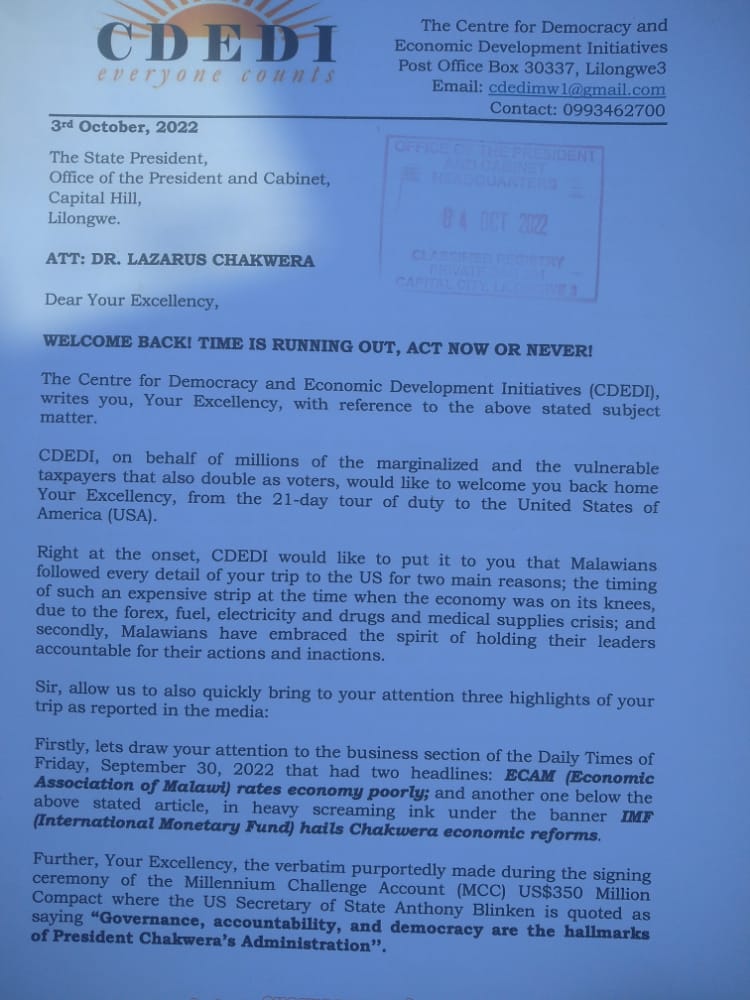

Already, Malawians are going through untold suffering, not as a result of a global economic downturn or a war in Ukraine, but as a result of poor decision making or lack thereof of this government.

It is, therefore, an insult to the people’s intelligence for the President to call for sacrifices from the people when his inner circle, including family members, are not willing to take those sacrifices themselves; when corruption is erupting among the President’s own trusted lieutenants. Mr President, nothing will happen if you do not lead by example.

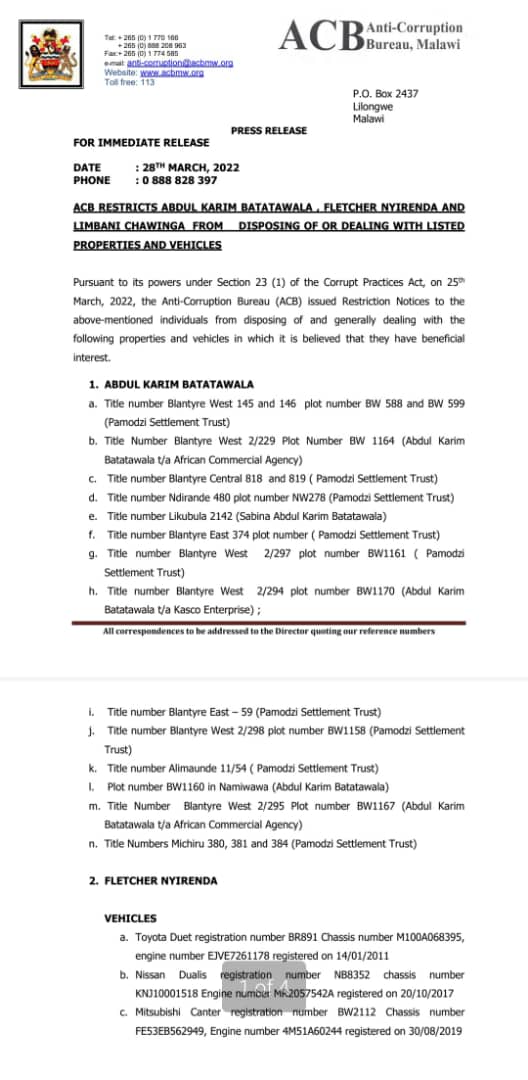

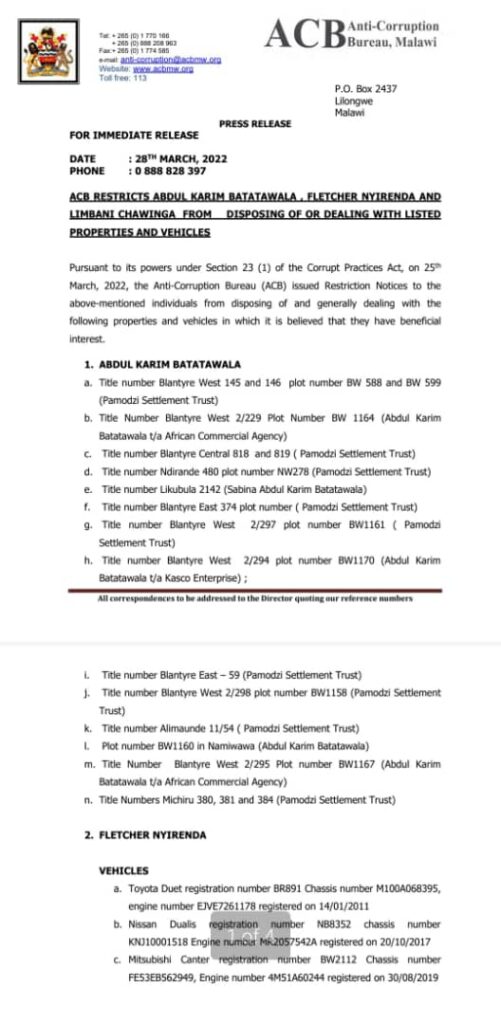

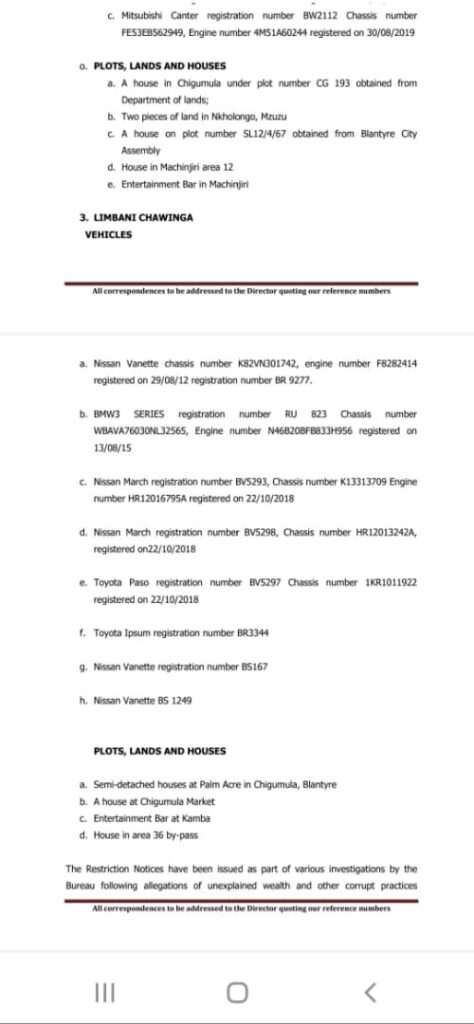

The President almost heaped blame on the slowness of conclusion of corruption cases on the Judiciary. In a subtle way, he did. However, my own opinion is that the Judiciary lacks adequate funding. The President knows it and he pretends all is well.

Madam Speaker,

In his SONA, I expected him to mention how much the Treasury has funded the New High Court Division and the Financial and Economic Crimes Division.

I am aware that the Division is underfunded. One wonders how the President expects that the fight against corruption would be seamlessly discharged without adequate funding for that Division.

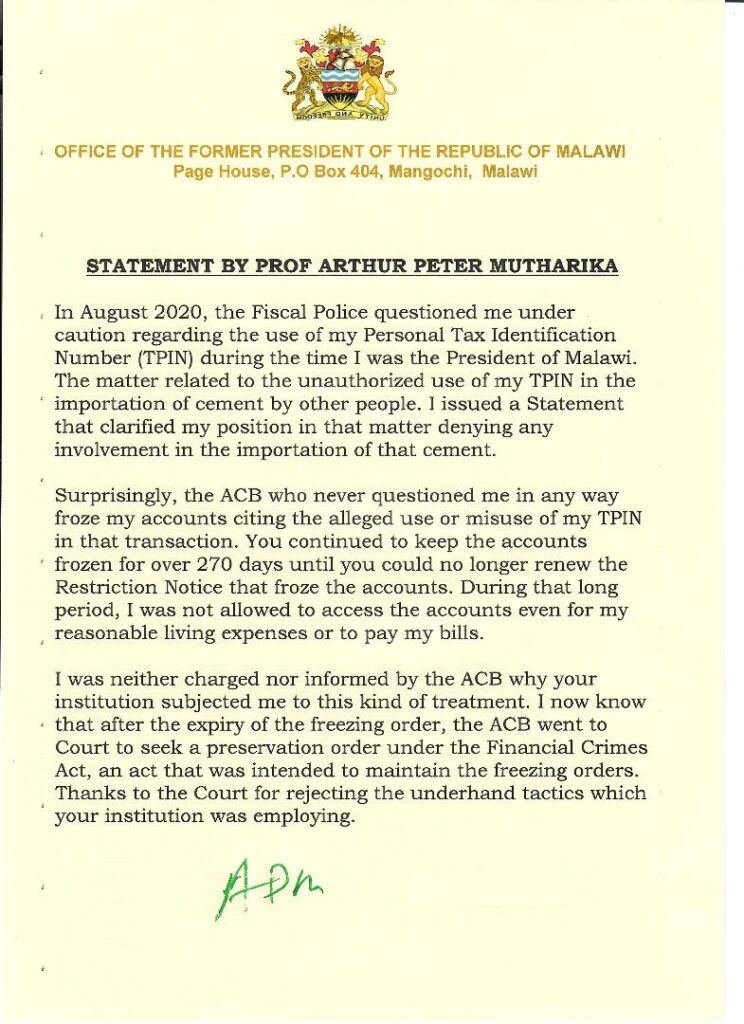

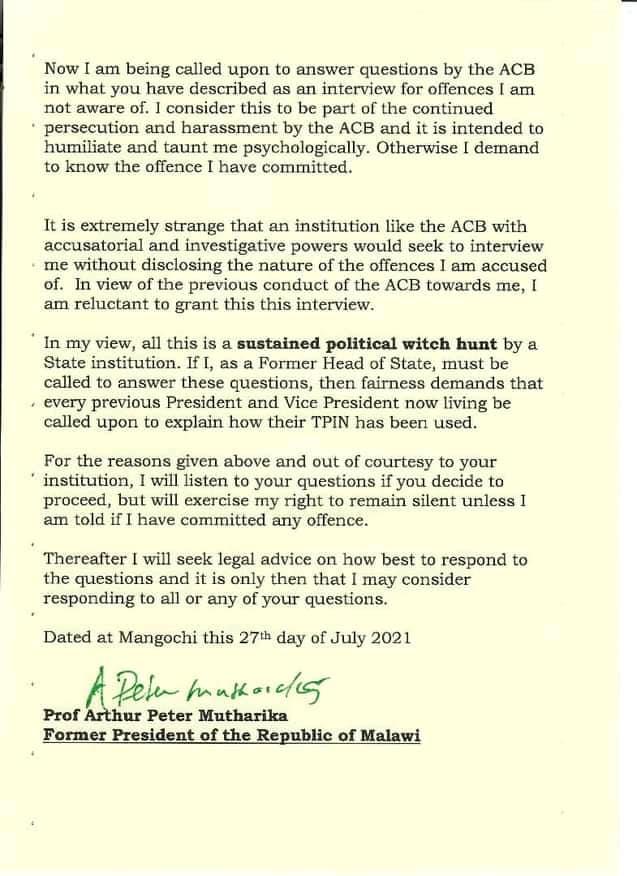

Funding the ACB and bragging about it every day does not help the fight against corruption if the courts are not adequately funded.

I am also concerned about the plight of the Judiciary support staff. I wish to request the government to review the conditions of service of Judiciary personnel as a matter of urgency.

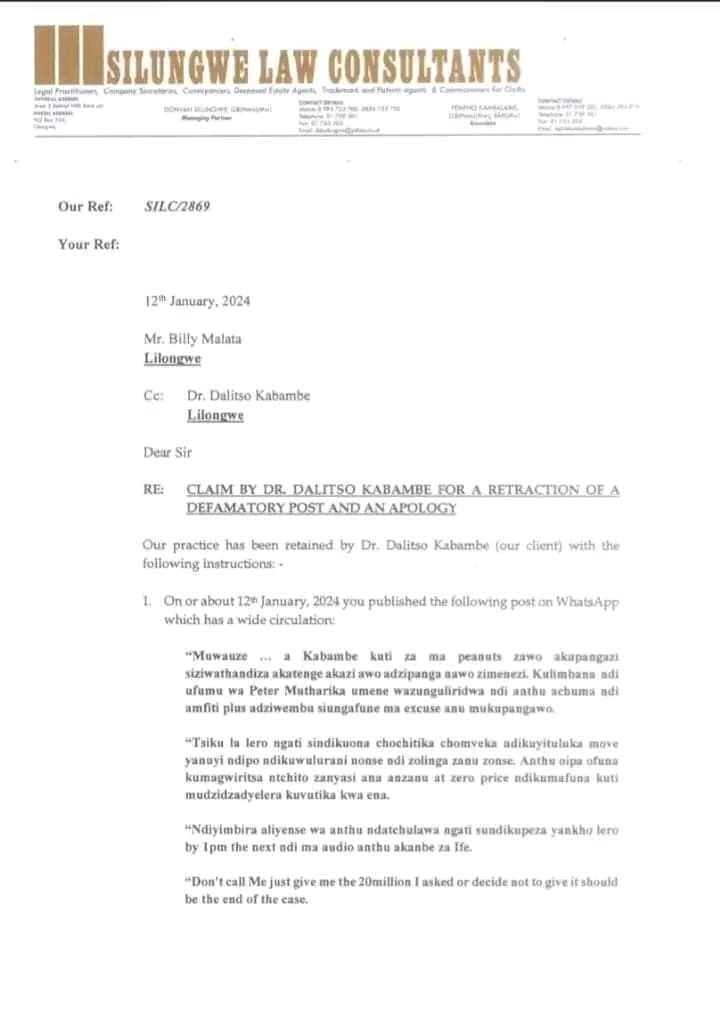

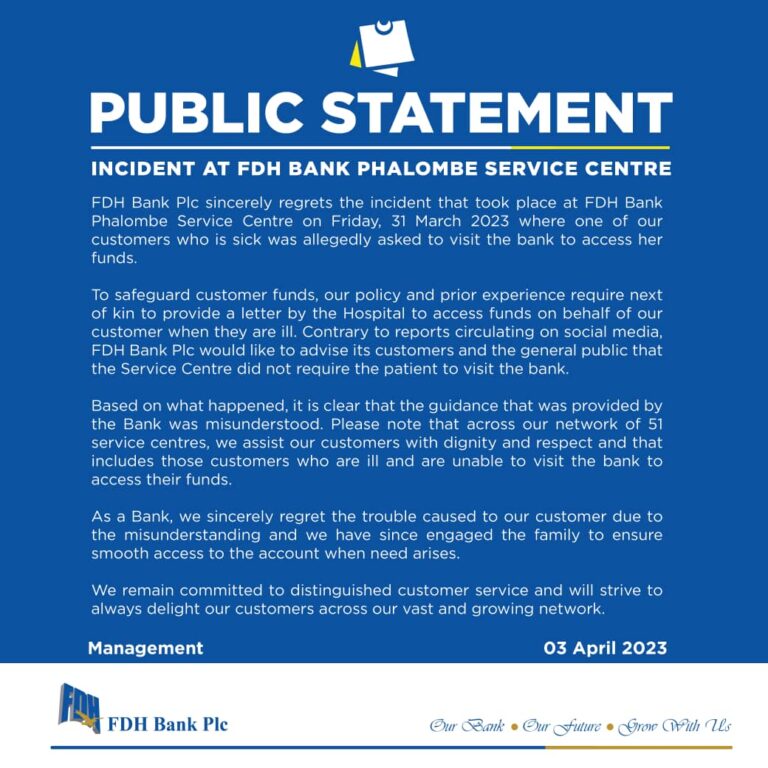

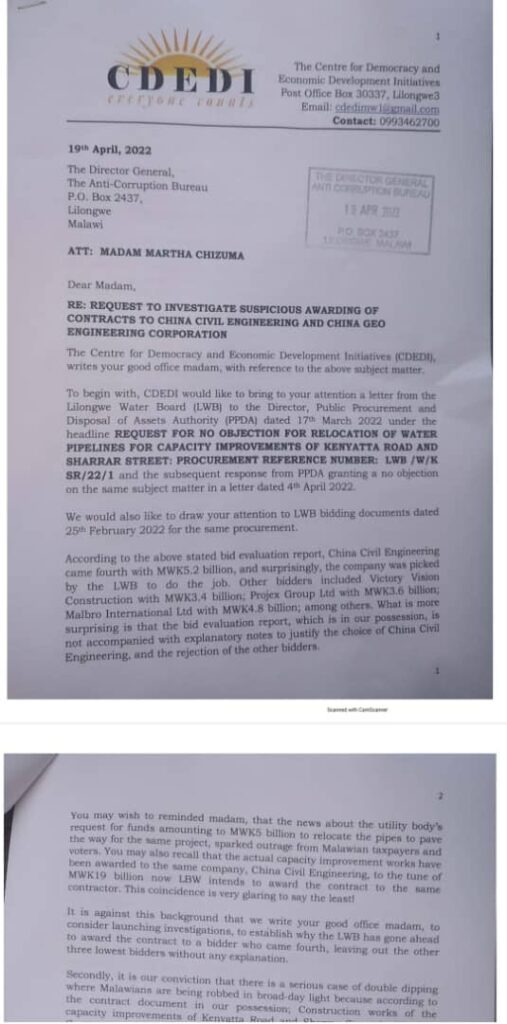

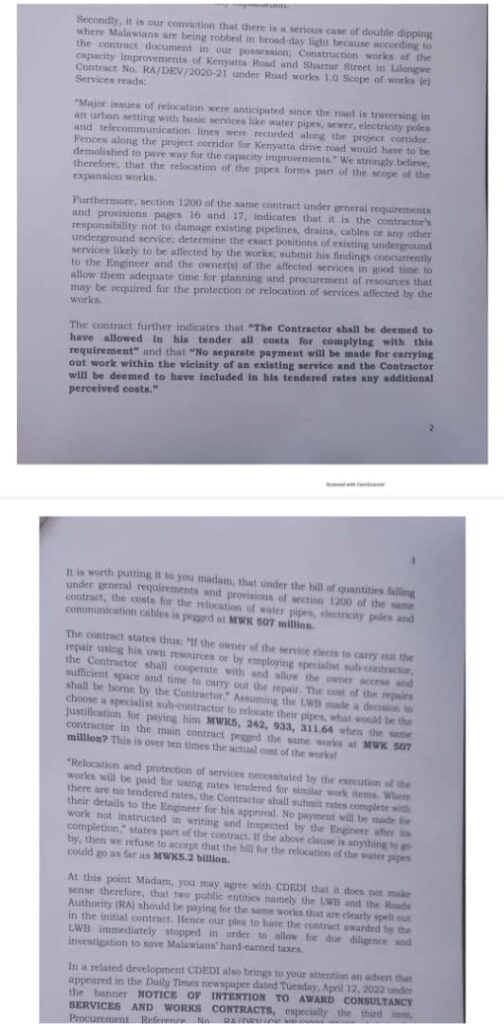

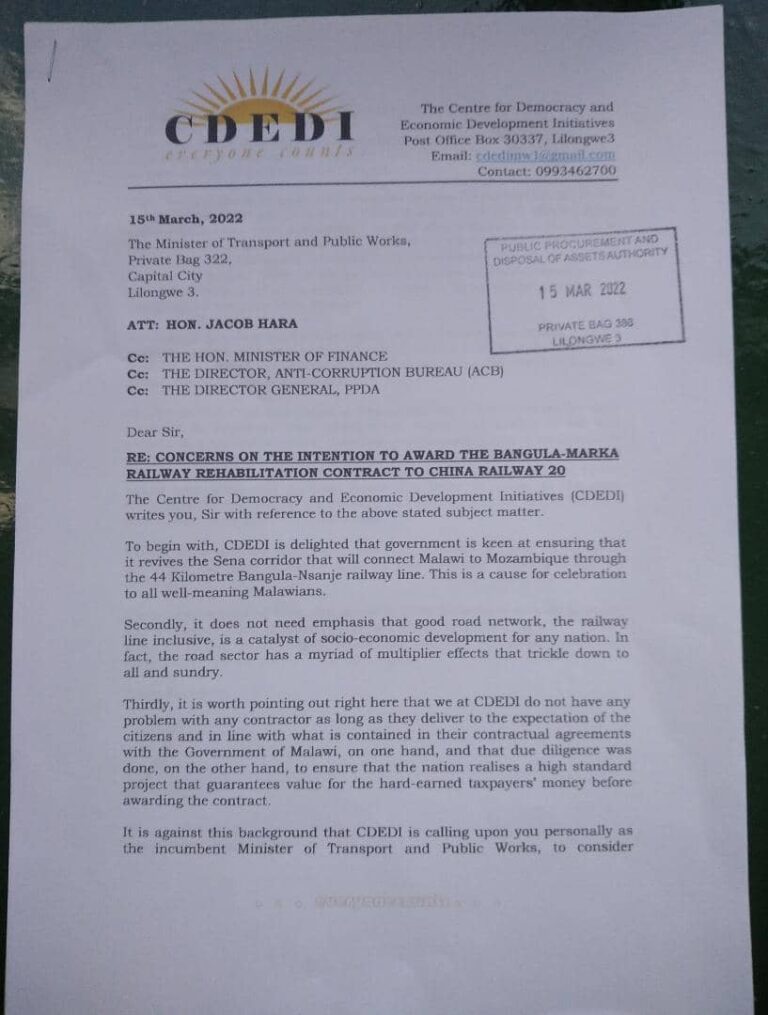

Madam Speaker,

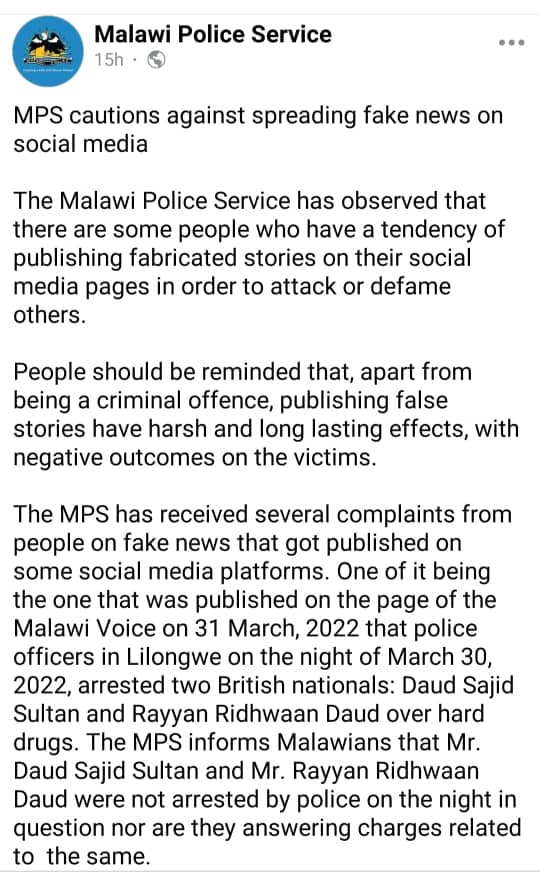

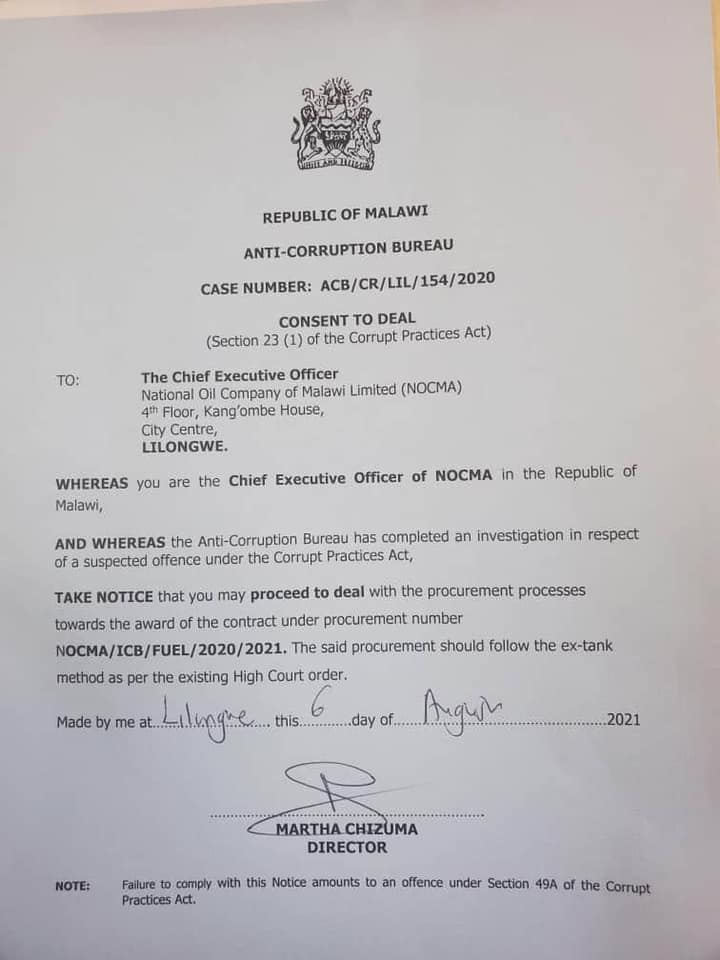

I wish to state that progress in the Sattar case is deliberately hindered by the Office of the Attorney General. As required by law, the ACB wrote the office to ask the British Government to have the National Crime Agency (NCA) there to provide evidence and share intelligence with the ACB so that these Sattar cases can be properly prosecuted. The Office of the Attorney General has been dilly dallying. I wish to demand that the Office of the Attorney General must do the needful as far as Sattar issues are concerned, as a matter of urgency.

Madam Speaker,

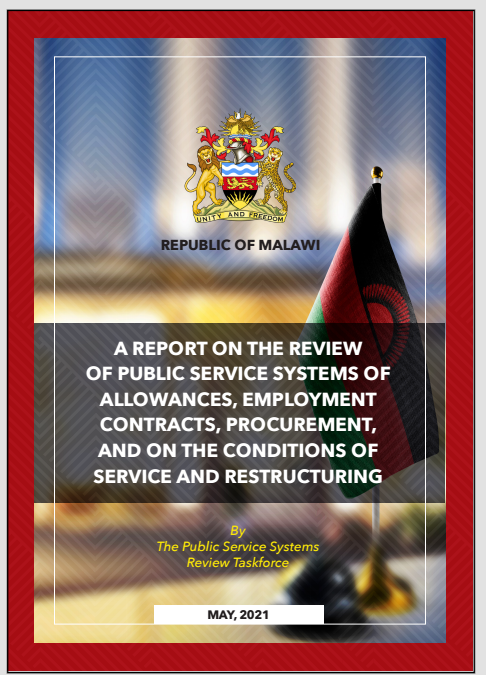

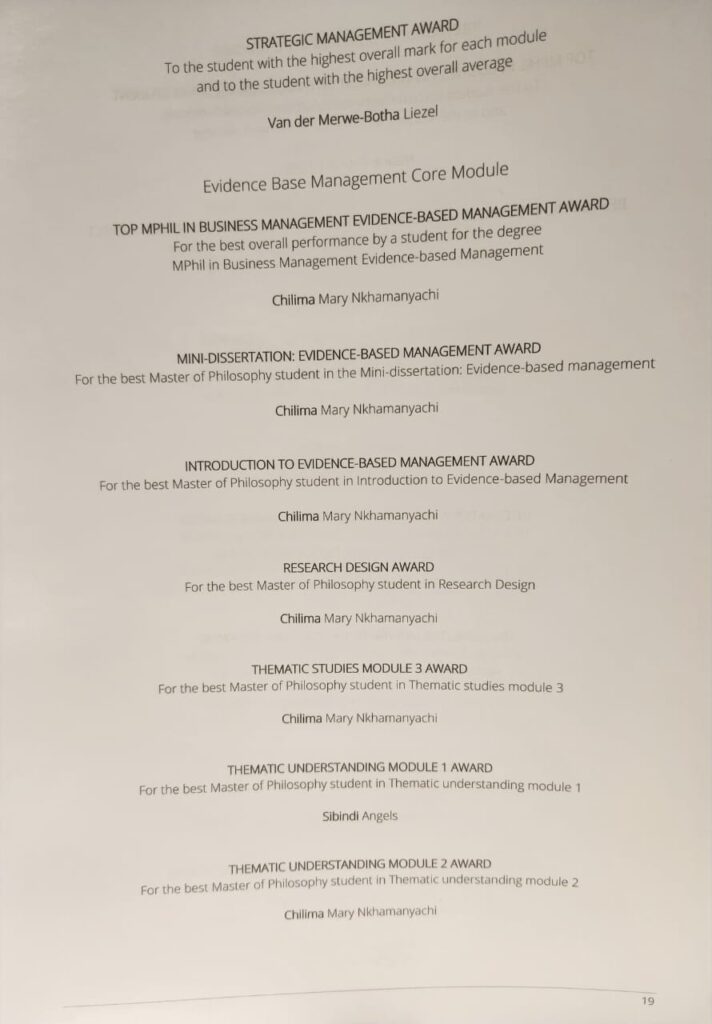

Since this government came to power, the President has been talking about reforms; about fixing the systems. Which reforms and which systems? Two things: One: Can the President do justice to these reforms by telling Malawians what he did with the ‘Chilima Civil Service Reform’ Report?

Where is that report; and what were the recommendations? Why is the President sitting on that report without releasing it, and even implementing its findings? Two: about fixing the broken systems as he said in the last SONA, what is the progress like? What has been fixed and what has not? I want to assure the President that Malawians have had enough of a ‘talking’ President; they want an ‘action’ President even if he doesn’t talk.

Madam Speaker,

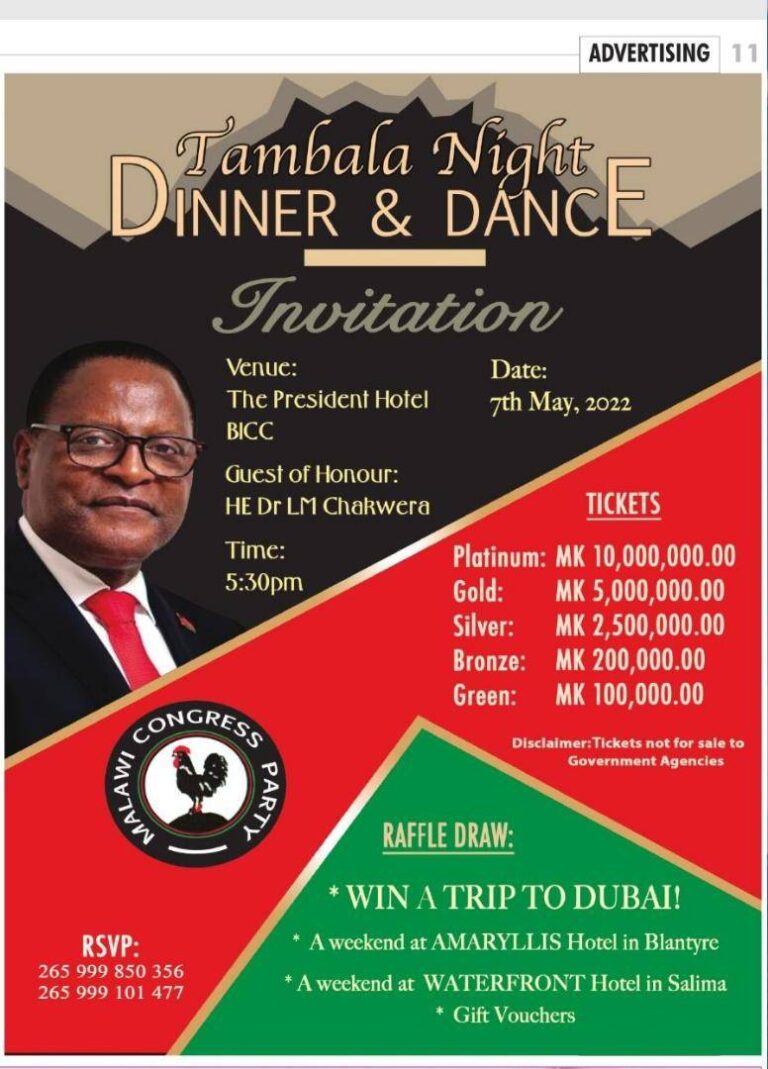

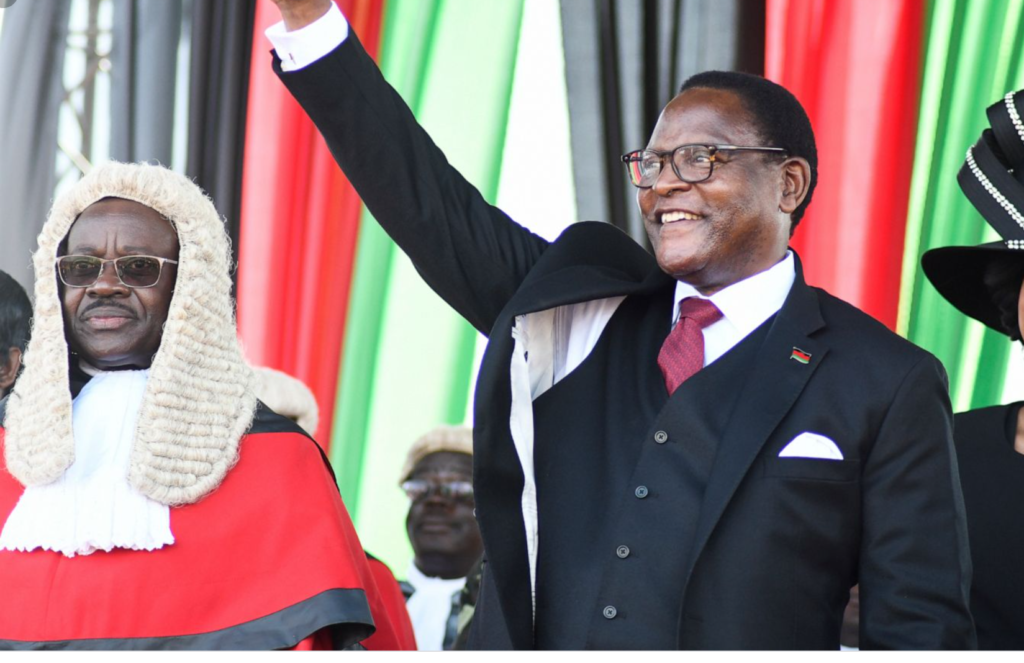

Before he came to power, President Lazarus Chakwera and his government placed the fight against corruption as a centrepiece of their campaign. It was one of the cornerstones of the Chakwera Hi-5.

Among other things, he said he would safeguard the integrity of the ACB, including removing appointing powers for ACB Director from the President.

Barely three years down the line, all that talk has remained just that. Talk. In fact President Chakwera and his Tonse Alliance panel have turned out to be the biggest stumbling blocks in the fight against corruption through their very action.

The fight against corruption under President Chakwera and his Tonse Alliance partners have been spurious to say the least, and a scatter-gun at most.

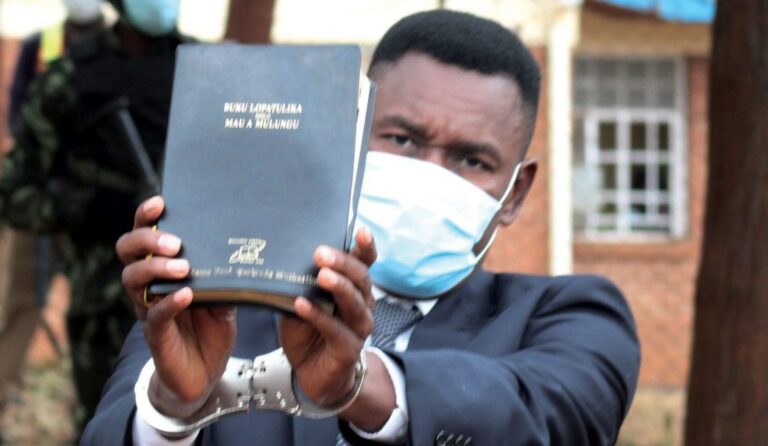

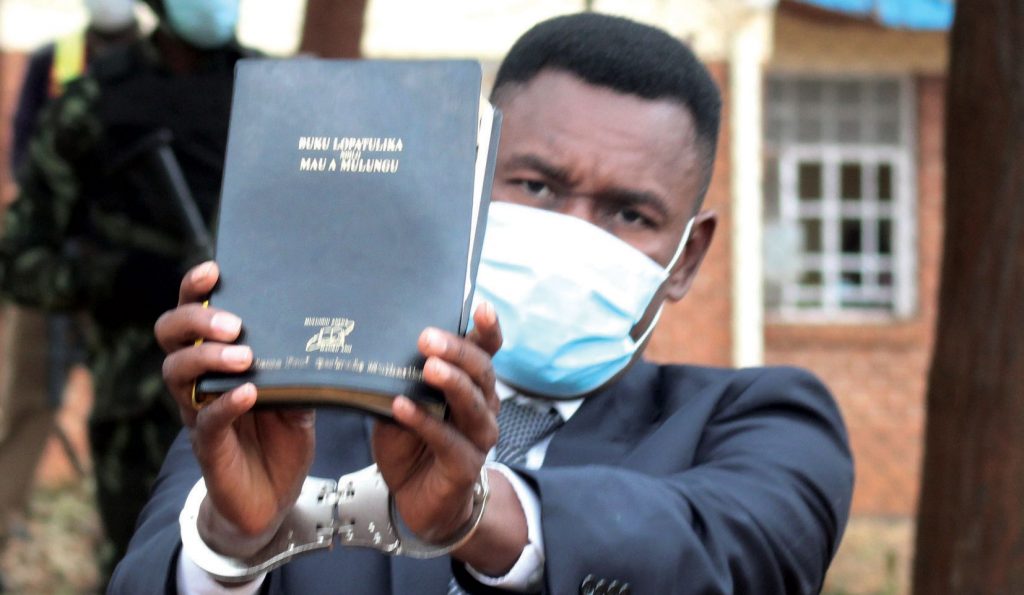

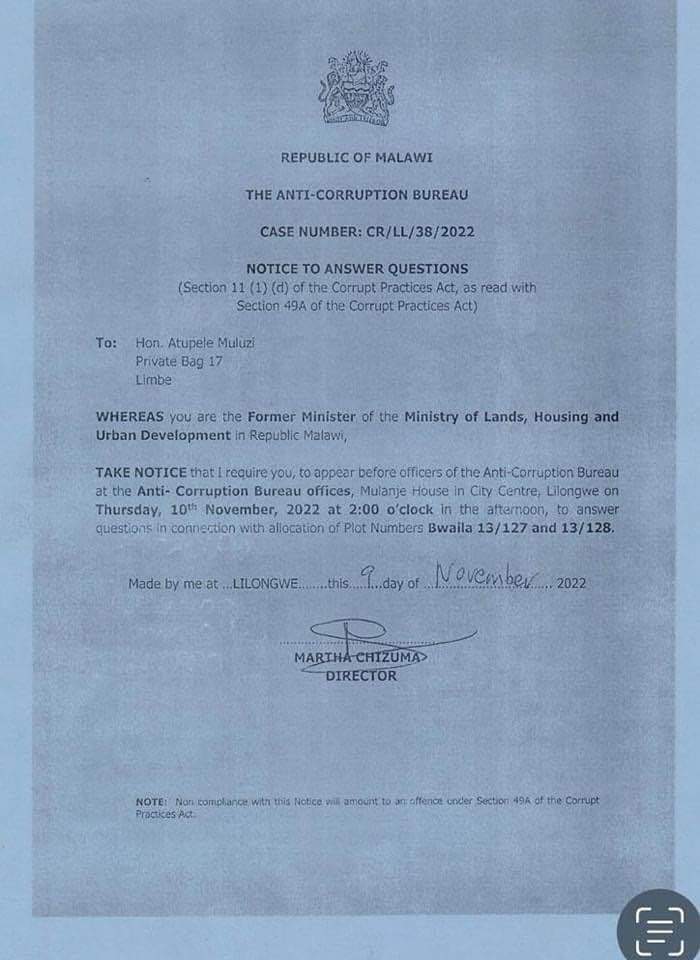

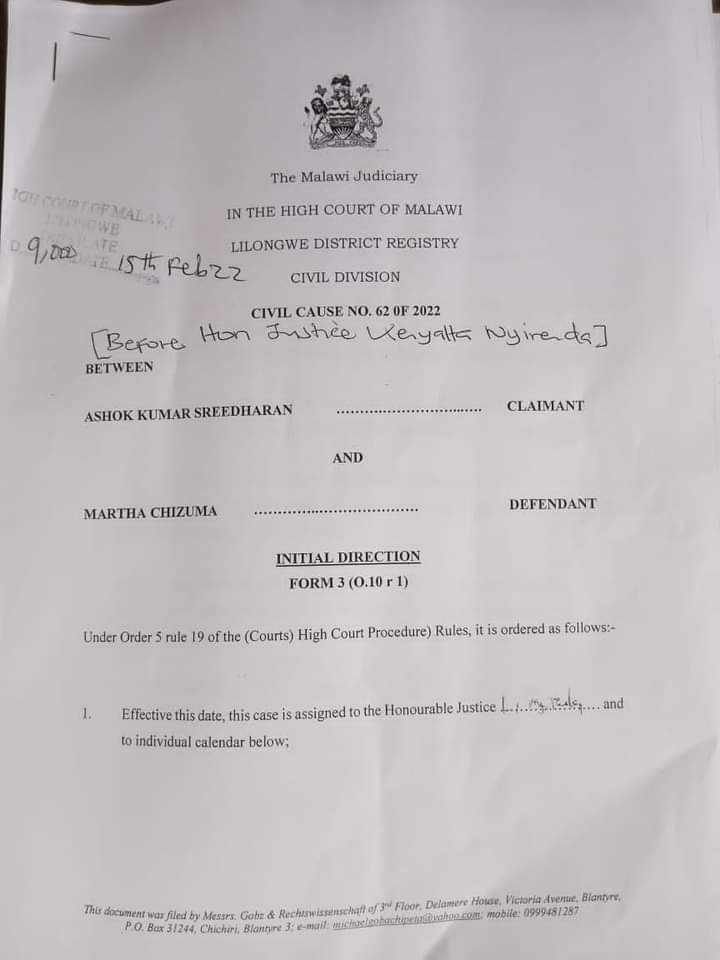

In fact, the President’s position in the larger scheme of the whole fight is that of a very dishonest man who cannot be trusted. The never ending story of the persecution of ACB Director, Ms Martha Chizuma is a very good example to sum up what I am talking about.

Madam Speaker,

In January 2022, President Chakwera said he knows that the ‘forces of darkness’ that recorded Martha Chizuma and deliberately leaked the audio so that she is found culpable and removed from her position.

He said he would not yield to such devilish wishes. He said he was standing behind the ACB Director and that he had forgiven her for whatever transgressions she may have committed.

I was sceptical, and I said it from the onset that this was all part of a larger scheme to remove Ms Chizuma and that President Chakwera was actually the Godfather of the whole plot.

Madam Speaker,

Fast track to December 2022, over 20 police officers arrested Ms. Martha Chizuma in a dawn raid like they were arresting a dangerous drug Lord. They did not allow her to put on proper clothing and drove her 50 kilometres away before locking her up, and leaving her traumatized.

This was the lowest moment in the fight against corruption in Malawi, and so unprecedented.

The President said he did not know anything. He quickly set up a Commission of Inquiry to establish circumstances surrounding the arrest, including finding out who actually ordered it.

Mysteriously, the President tweaked with the terms of reference for the Commission. It ended up with findings that were far removed from the questions that Malawians were asking. Up to now, Malawians still don’t know who actually ordered the arrest of Martha Chizuma.

Madam Speaker,

I know this may look like ‘The Godfather’ movie but it is actually what this government calls the fight against corruption. When President Chakwera’s own Secretary to the President and Cabinet, Ms Colleen Zamba, interdicted Ms Chizuma last month it is when we knew who was behind the plot to remove her from her position. President Lazarus Chakwera.

The President did not say anything about the interdiction of Ms Chizuma. He still has not said anything up to now, as usual preferring to work behind the scenes like he does not know anything.

What is sad about the whole fiasco is the desire by President Chakwera and his panel of suspects to fight Ms Chizuma through the court process, including sponsoring so called Civil Society Organizations to bad mouth and fight donors for simply speaking out against the persecution of the ACB Director.

We have now heard of words such as ‘Malawi is a sovereign state’ coming from the government telling donors due to their critical stance on corruption. Is President Lazarus Chakwera Serious? Is he sure he wants to take Malawians on a Kamikaze mission to fight donors? On this, I can bet my last penny that Malawians do not want to sink with him. Let the President go alone on that road.

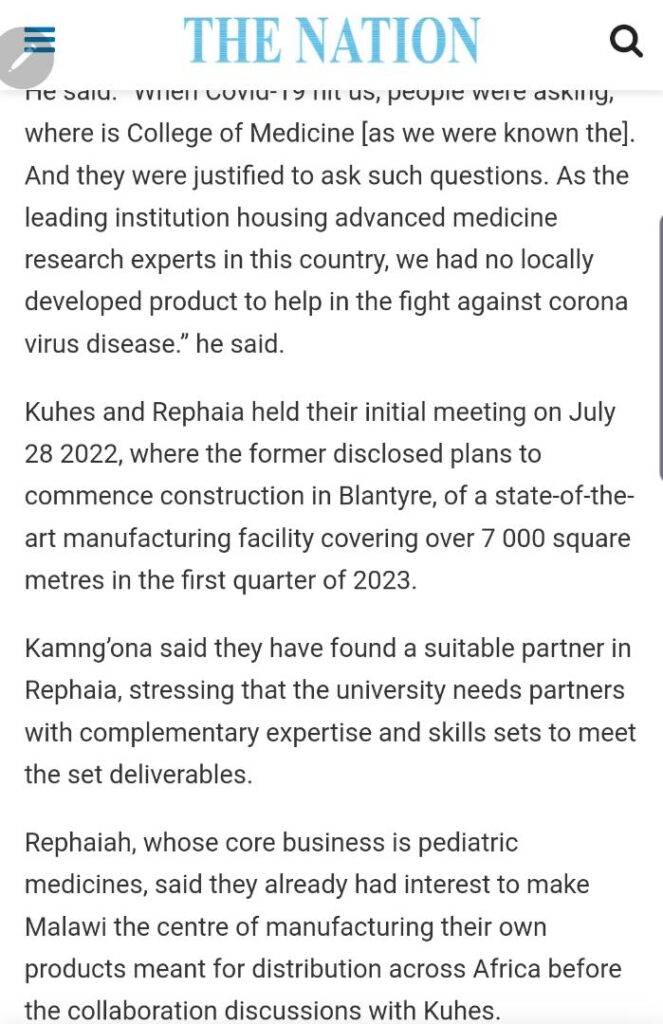

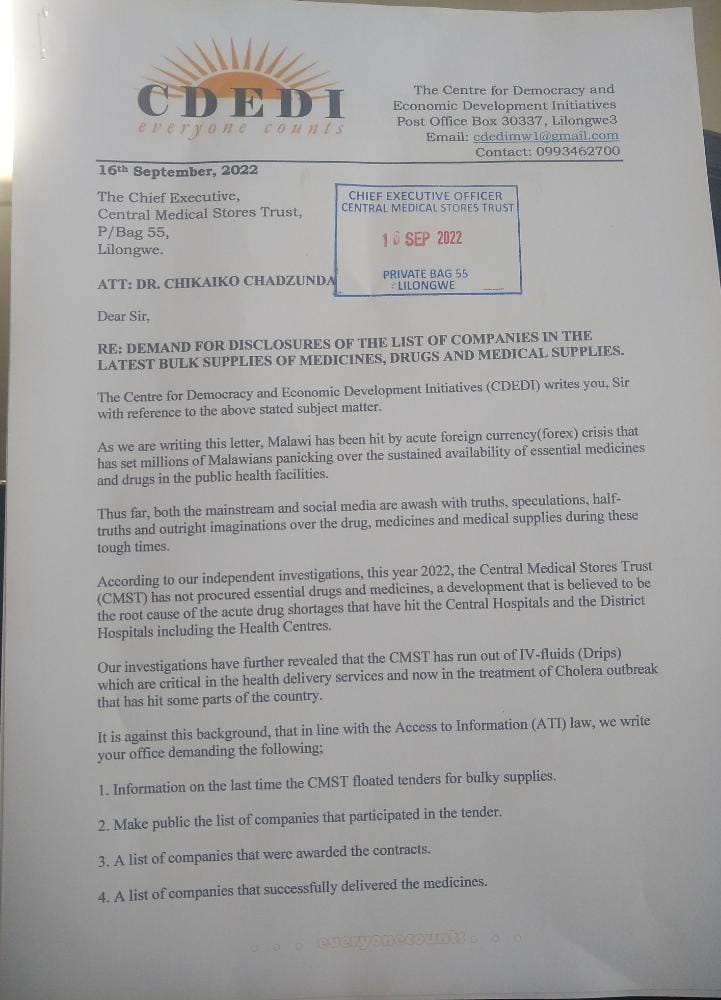

ON THE FIGHT AGAINST CHOLERA/THE HEALTH SECTOR

Madam Speaker,

In December, I made a statement to the effect that the government, through the Ministry of Health, is losing the fight against Cholera. That time over 20,000 cases and 700 deaths had been reported. I urged the President to declare a state of national disaster in order to unlock aid towards the situation from international and local partners

As usual, my advice fell on deaf ears. The government continued to behave like there was no crisis despite the fact that the health sector was collapsing due to the lack of capacity, and preparedness. And yet the first cases of cholera were reported in the country in March 2022.

Madam Speaker,

The government continues to write all the wrong scripts in the health sector. The Cholera outbreak has gone out of control because it was given cursory attention like a small ailment that would go away with regular painkillers, and yet it was a time bomb waiting to explode.

When it exploded, the government looked to have been caught off-guard. The launch of the fight against Cholera at Mgona in Lilongwe was little action taken too late. In fact, what does it mean?

Madam Speaker,

The health sector has been transformed into a sector of death under this government. It is now a ‘death sector’. Hospitals lack basic supplies of drugs including inadequate personnel. People are dying en-masse in health facilities due to systematic neglect by this government.

Madam Speaker,

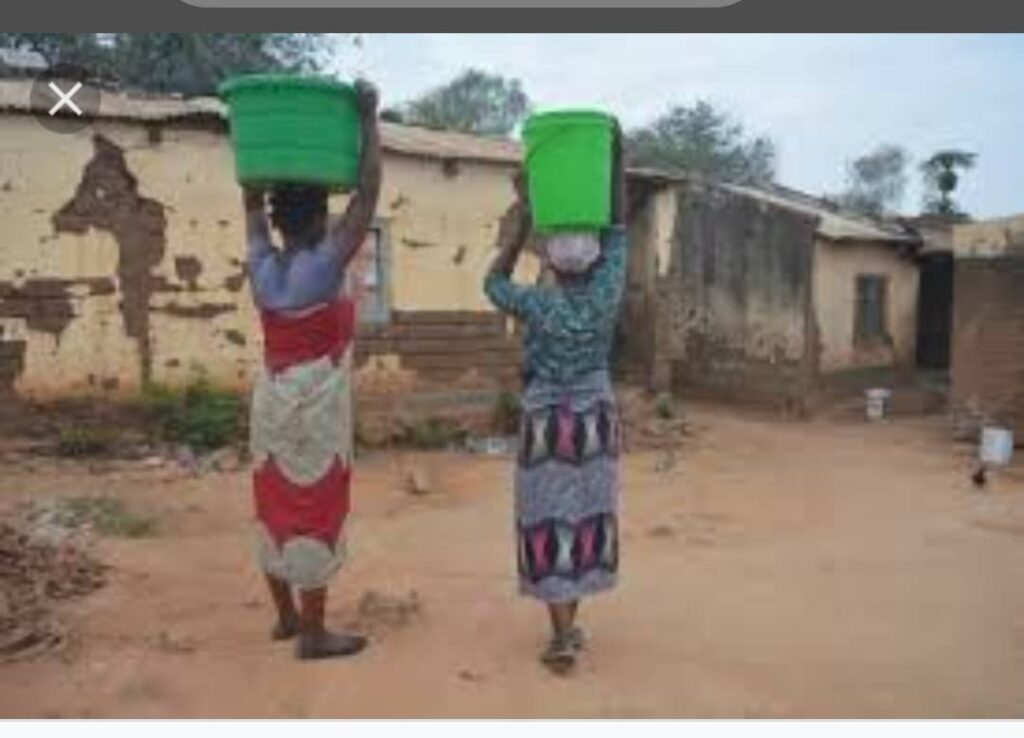

One of the key factors in fighting Cholera is access to clean water. Is there anything the government is doing to ensure access to clean water when even hospitals have dry taps, and don’t have clean water?

I submit that effective leadership or lack of it manifests during a crisis like the current Cholera outbreak. So many people who could have contributed to the development of this nation have lost their lives and more will lose lives due to nothing but leadership failure to manage a crisis.

Madam Speaker,

The Lazarus Chakwera leadership has been tested and has failed.

ON ENERGY AND OTHER MATTERS

Madam Speaker,

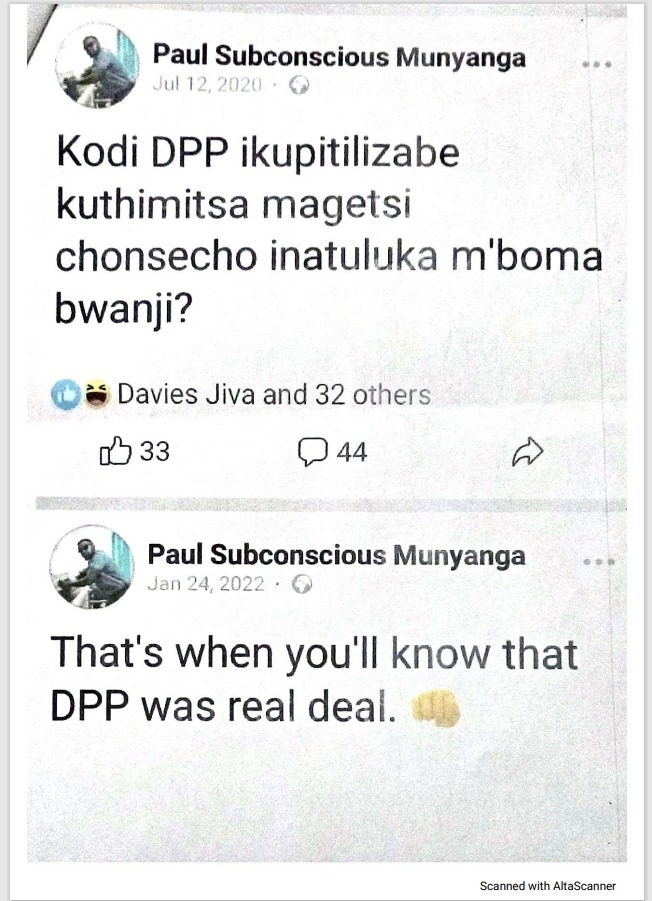

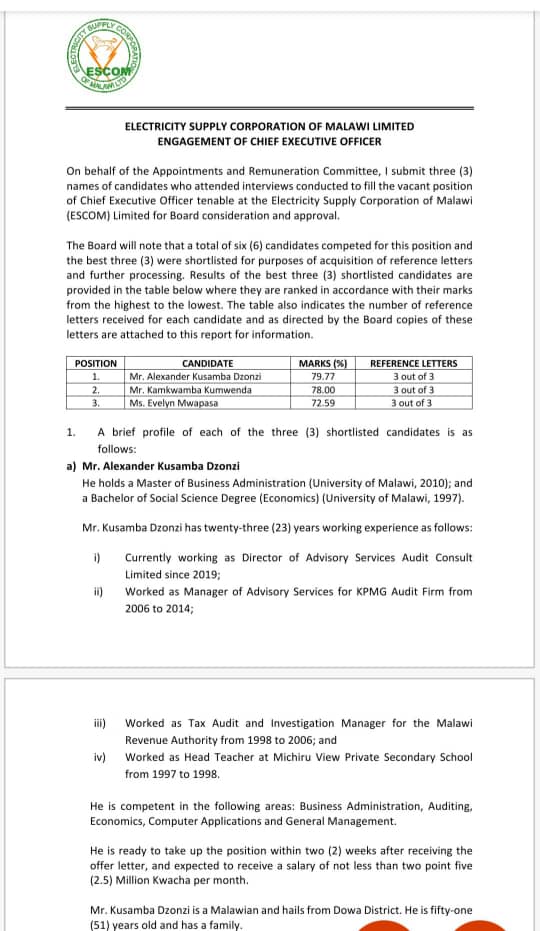

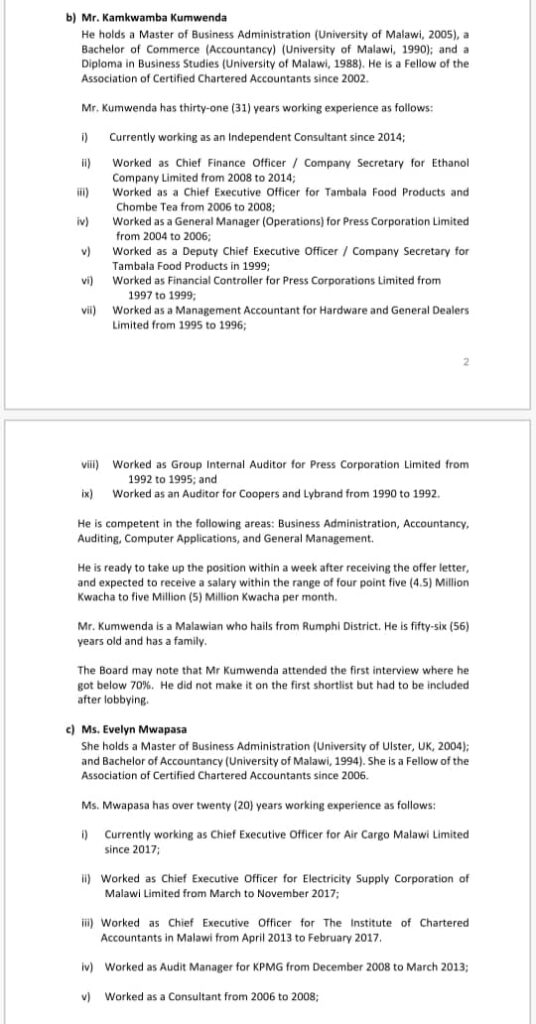

I do not need to emphasize the importance of energy in an economy that wants to grow and shrive. But our energy story is embarrassing to tell. With electricity as a specific example, our country has witnessed the worst energy crisis ever in the history of the country.

The President promised he would decisively deal with blackouts. To put it in his own language, “blackouts would be a thing of the past”. Madam Speaker, three years down the line, the president and his government have only managed to deliver massive blackouts, and nobody is coming out to tell Malawians in clear brews how we will get out of here.

OTHER DESCRIPTIVE MATTERS OF THE NATION

British Philosopher Bertrand Russell once said that perhaps the world was created by his enemy, Satan, when God was not looking. He could not understand why a God of so much loving kindness could allow so much suffering among his people.

Allow me, Madam speaker, to analogize that since so many things are happening in this government without the knowledge of the President, perhaps some of these things are happening when President Lazarus Chakwera is not looking. I, therefore, want to bring the President to reality.

Madam Speaker,

Does the President know that:

• His SONAs are delivered in nice English but very loud for their emptiness.

• That his government has no direction on how to reduce the local and foreign debt.

• That his government has no clear direction on ADMARC and agricultural markets in general.

• That there is no clear direction on blackouts and increasing the country’s power production.

• That his government has no clear direction on increasing exports.

• That his government has no clear direction on job creation, and that the 1,161,000 new jobs that he said his government has created only exist in a computer somewhere at Capital Hill.

• That his government has no clear direction on national security, and that security is fast deteriorating in this country

• That there is no clear direction on how to improve our health, agriculture, education and social welfare.

• That there is no clear direction on fighting corruption in this country. That instead of fighting corruption, his government is fighting Ms Martha Chizuma

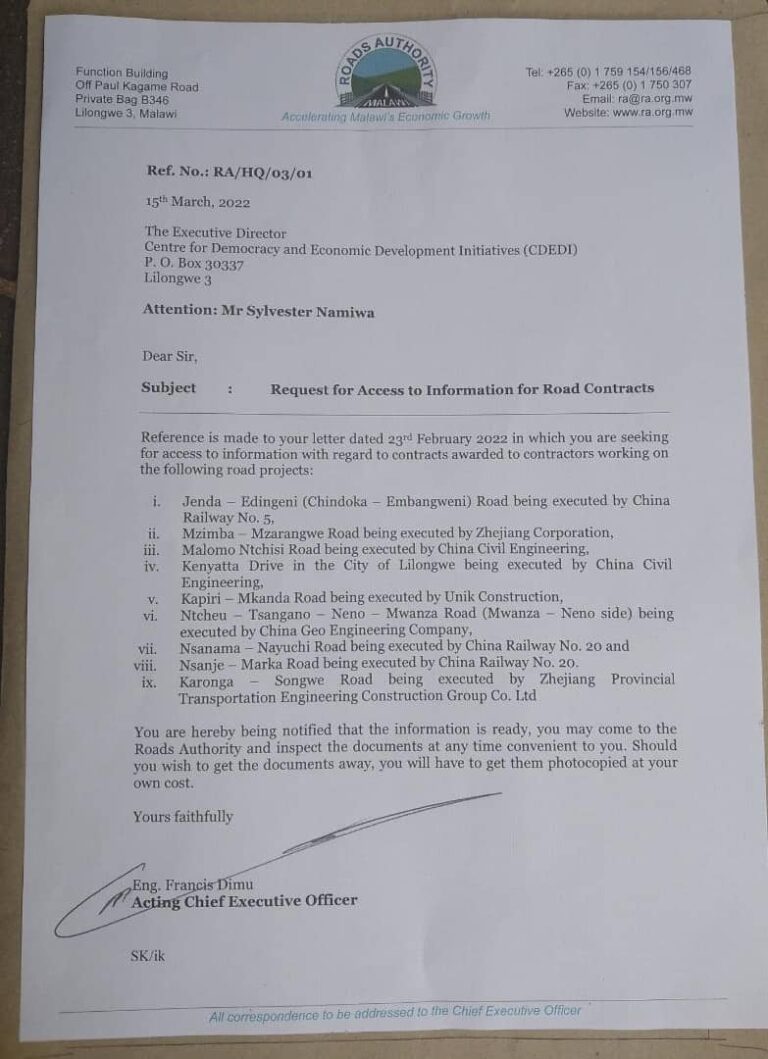

• That there is no clear direction on how to improve public infrastructure including roads.

• That there is no explanation or direction on recent fertilizer scandals, and how the government will make sure that fertilizer prices go down.

• That there is no direction or explanation on how the country is going to deal with fuel issues like we experienced last year.

• Is the President aware that his SPC was pressurizing Helen Buluma to pay a middleman called Mr Chief the sum of $ 20 million for doing nothing?

• That his SPC was summoned by Parliament to respond to serious allegations of corruption made against her by the former CEO of NOCMA but she refused, and he did not reprimand her.

• That in his speech, he did not mention the Bridging Foundation, a foundation set to bring about 7 trillion Kwacha worth of grant to this country.

• Is President Chakwera aware that 17 trucks of maize meant for NFRA from ADMARC were stolen by his close friend and sold to Tanzania and that his friend revealed that there are also ‘big’ people doing the same thing?

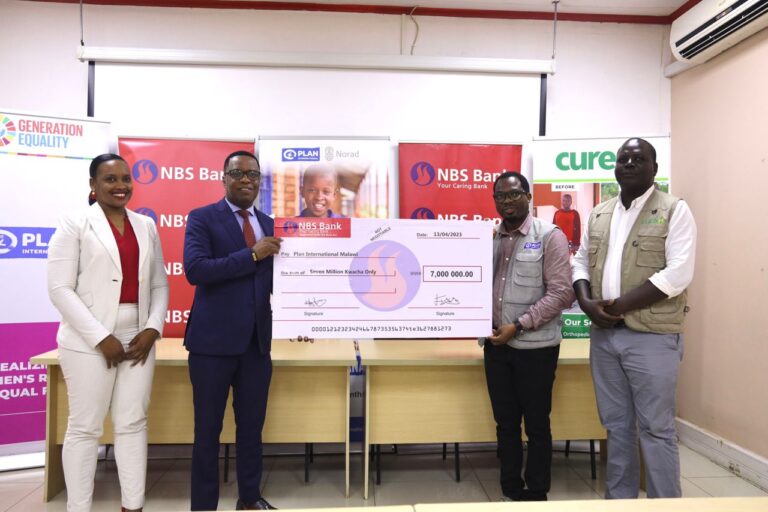

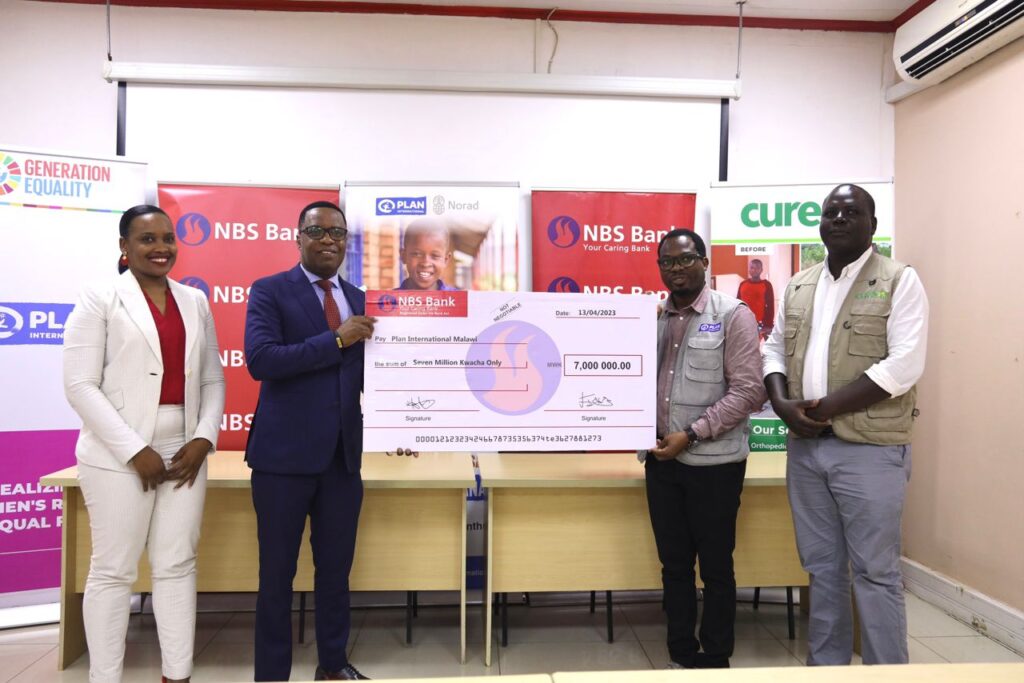

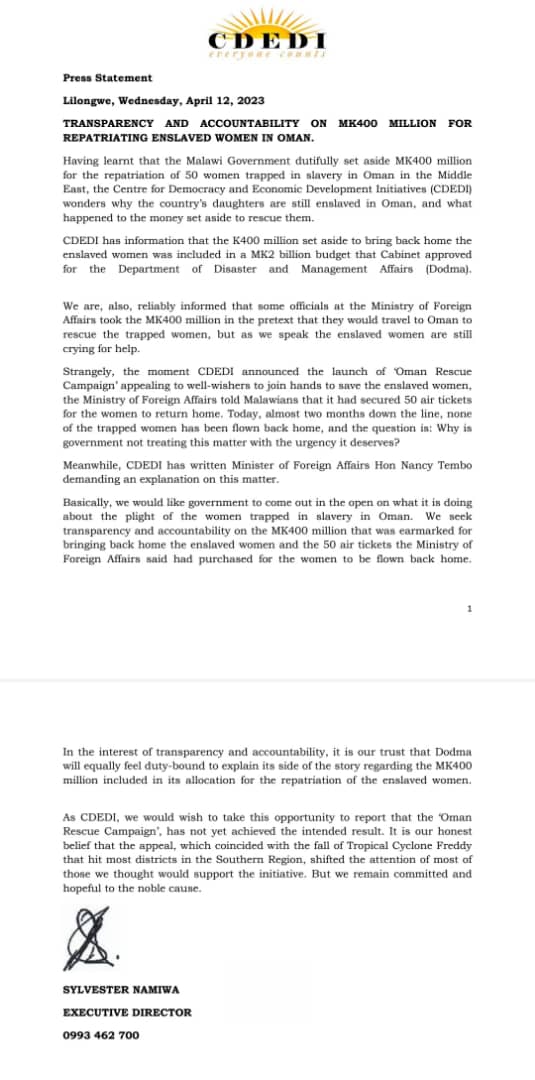

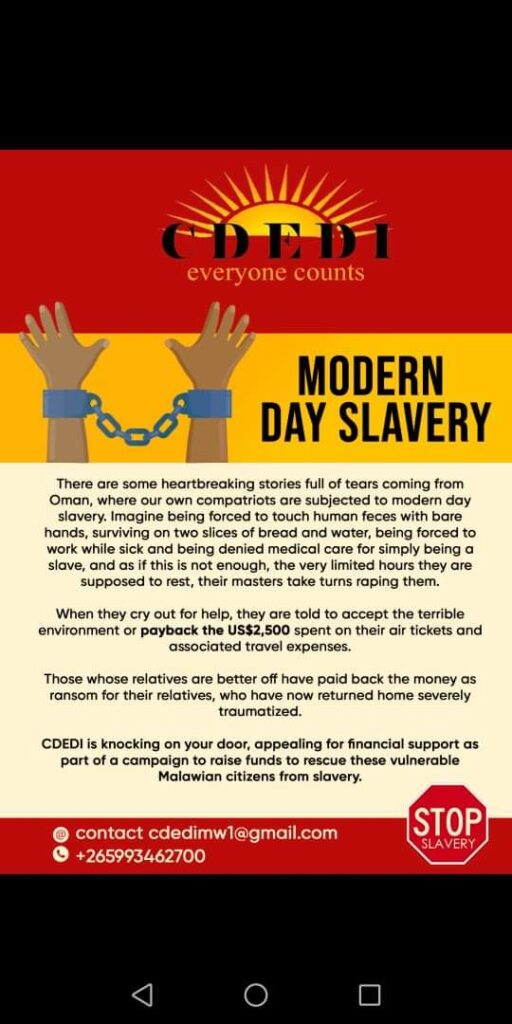

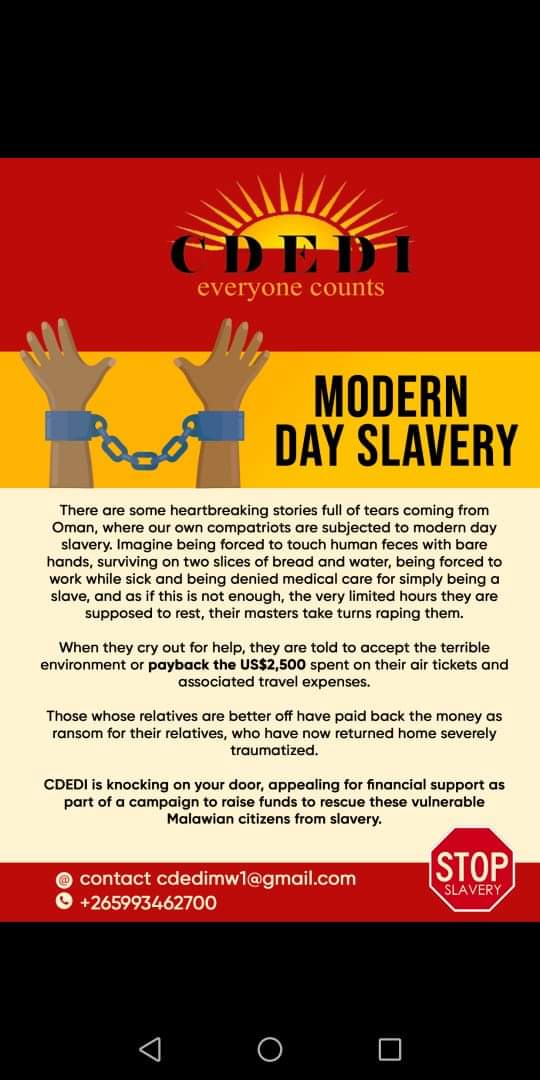

• Is President Chakwera aware that his government is failing to repatriate 376 Malawian female domestic workers stuck in Oman and facing various forms of human rights abuses?

• Is President Chakwera aware about the elderly being tortured on a daily basis based on witchcraft allegations?

• Is President Chakwera aware that his government is collecting collateral from Malawians without disbursing loans under NEEF?

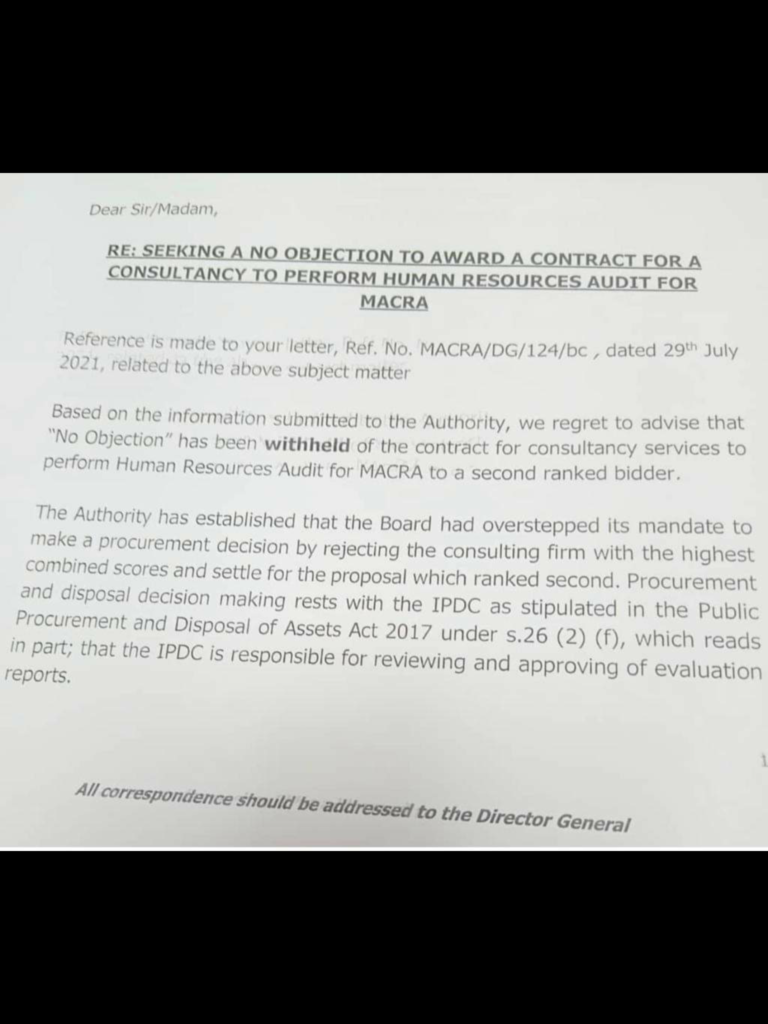

• Is President Chakwera aware that the relocation of government offices such as MEC, Immigration and MACRA from Blantyre to Lilongwe is economically suffocating Blantyre?

• Is President Chakwera aware that prolonged blackouts are crippling small businesses?

• Is President Chakwera aware that Malawi Defence Forces (MDF) soldiers get K1000 as allowance when they are on duty?

• Is President Chakwera aware that 800 US Dollars is deducted from MDF soldiers’ allowances when they go on peacekeeping missions abroad when they are supposed to receive 1,700 US Dollars per month?

• Is the President aware about the plight of ex-PTC workers, and that they have not been paid their surveillance payment? And that Malawian traders who have been supplying products and services to PTC have not received their money?

CONCLUSION

Madam Speaker,

I wish to reiterate that what the President came here with just a compilation of platitudes and a wish list that unfortunately does not have any chance of being implemented. I am saying this based on the experience that Malawians have had under this government.

When somebody says they have done something and spend hours explaining what they have done, it means they have done nothing. When you have done something, you shut up the things you have done speak for themselves.

Madam Speaker,

If the ship that Jonah boarded from Nineveh to Tarshish had a sleeping captain, the ship could have sunk because the captain would not have known the cause of their troubles.

But bravo to the captain of that ship because he was awake and alert to recognize the problem in time and fixed it by throwing Jonah into the lake to save the ship and the people. Our circumstances are very unfortunate because the captain is loudly slumbering on the job.

THANK YOU, MADAM SPEAKER, AND ALL HONOURABLE MEMBERS FOR YOUR KIND ATTENTION